Labeling and Product Characteristic Preferences of Organic Food Buyers

Introduction

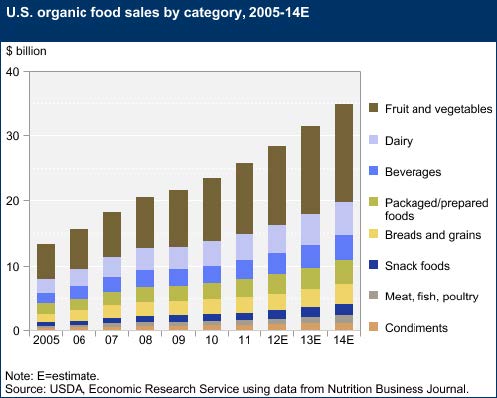

Consumer demand for organically-grown foods has grown exponentially since the early 1990s (See Figure 1). Organic products are now available in approx. 80% of traditional grocery stores, and often command substantial price premiums over conventionally-produced foods (ERS, 2014). In 2016, the total sales of organic foods were $43 billion in the U.S. alone, just over 3.5 times the amount in 2005 (OTA, 2017).

In 2013, organic food-grade wheat averaged from $14.90/bushel to $16.30/bushel (up $1.50 to $3.00/bushel from 2012) depending on type, compared to conventionally grown wheat priced between $6.00 to $7.50/bushel. Organic breads and grains, the primary use for wheat, accounted for 9% of US organic food sales in 2014 and represented the fifth largest category of organic foods sold. The organic breads and grains category has grown steadily since 2005 (ERS, 2014).

This Extension fact sheet discusses the results of an online survey conducted in 2017 across 16 western states via Qualtrics. Just over one thousand residents responded to the survey. The goal of the survey was to examine what types of consumer characteristics, attitudes, concerns, and past consumption habits define a typical consumer of organic wheat products and also examine what factors play into their organic food purchase decisions. Survey respondents were placed into three groups based upon their propensity to purchase organic breads and cookies. The survey asked respondents to specify the quantity of their organic bread and cookie purchases in the last month and also gave them a set of purchase decisions involving organic breads and cookies, also containing additional labels to choose from. The groups included “very likely,” “likely,” and “unlikely.” Of those in the “very likely” group, 83% had purchased organic bread in the past month. In addition, consumers in this group chose organic bread in seven out of eight purchase scenarios. About 10% of the survey respondents made up the “very likely” group. There were fewer survey respondents that were very likely to purchase organic cookies, just 5.8% of respondents made up the “very likely” group for this product and 79% claimed to have purchased organic cookies in the past month.

Labels of Importance

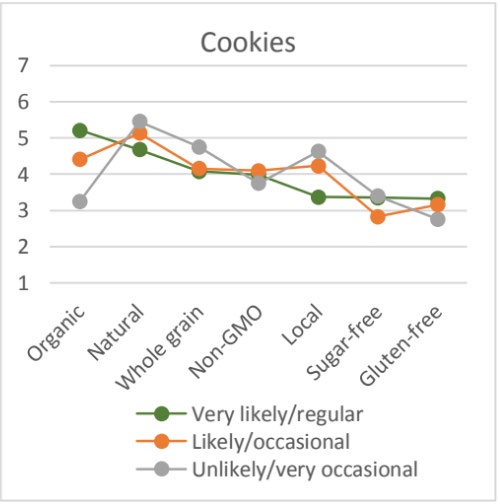

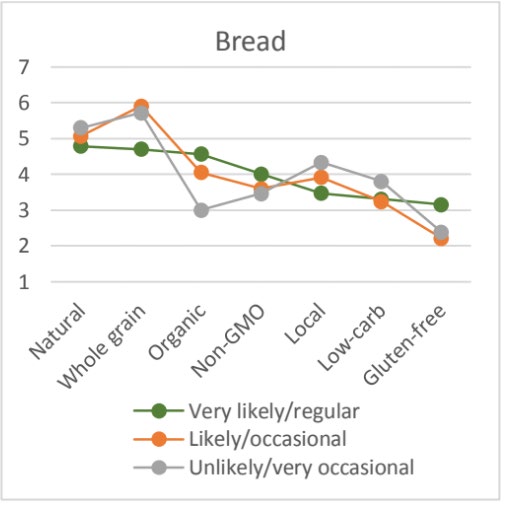

Survey respondents were asked to rank the importance of seven food labels for bread products on a scale of 1 to 7, where 1 is unimportant and 7 is very important. The “very likely” group ranked the label natural as the most important (See Figure 2). The labels whole grain and organic were also very important to this group. Interestingly, non-GMO was less important and the “very likely” group also ranked the local label below the “likely” and “unlikely” groups. The two other groups, “likely” most important and the “unlikely” group ranked organic as the least important label, unsurprisingly. Gluten-free was not very important for any of the consumer groups. When the respondents were asked about important labels for cookies, the “very likely” consumers ranked the label organic as the most important (Figure 3). The other two groups ranked natural as the most important and also highly ranked local. The sugar-free and the gluten-free labels were the least important for all groups for of cookies. Hence, the importance of food labels was quite different between the staple product bread and the special product cookies, with the exception the gluten-free and low-carb/sugar-free labels suggests that “very likely” consumers of organic bread are overall more likely to be interested in bread labels.

Similar to bread, “very likely” consumers have purchased organic cookies more often than the other two groups and this group also expressed more interested in cookie labels than the other two groups. But, the rate of consumption of labeled cookie products was much different overall from bread products. Non-GMO, home-baked, and low-sugar cookie products were consumed more than breads with similar labels.

Importance of Product Characteristics

Survey respondents were asked to rank the importance of various bread and cookie characteristics on a scale of 1-8, where 1 was “most important “and 8 was “least important.” For bread, freshness and taste were very important to all three groups and product origin was the least important. Price was more important for the “unlikely” group and safety was not very important to either the “likely” or the “unlikely” group. Product pricing was less important for both bread and cookie products for the “very likely” group, especially for cookies. This group valued product safety more than the other two groups as well. Hence, organic consumers are less price sensitive and are concerned with health and safety, but aren’t willing to compromise on taste or freshness.

Table 1: Purchased Bread and Cookie Products by Label

| Label | Bread | Cookies | ||||

|---|---|---|---|---|---|---|

| Very likely | Likely | Unlikely | Very likely | Likely | Unlikely | |

| Organic | 79% | 34% | 16% | 79% | 41% | 12% |

| Whole grain | 54% | 58% | 45% | 29% | 15% | 6% |

| Non-organic | 41% | 39% | 38% | 32% | 36% | 31% |

| Local | 38% | 27% | 27% | 34% | 32% | 21% |

| Non-GMO | 31% | 15% | 9% | 40% | 21% | 8% |

| Gluten-free | 31% | 7% | 6% | 27% | 20% | 7% |

| Home-baked | 22% | 9% | 16% | 31% | 30% | 28% |

| Low-carb/sugar-free | 20% | 6% | 8% | 31% | 20% | 15% |

Table 2: Importance Ranking of Product Characteristics (Scale of 1-8, 1 is important)

| Product Characteristic | Bread | Cookies | ||||

|---|---|---|---|---|---|---|

| Very likely | Likely | Unlikely | Very likely | Likely | Unlikely | |

| Freshness | 1 | 2 | 1 | 1 | 2 | 2 |

| Taste | 2 | 1 | 2 | 2 | 1 | 1 |

| Nutrition | 3 | 3 | 4 | 3 | 7 | 6 |

| Price | 4 | 4 | 3 | 7 | 3 | 3 |

| Safety | 5 | 7 | 7 | 5 | 6 | 7 |

| Appearance | 6 | 5 | 5 | 4 | 5 | 4 |

| Brand | 7 | 6 | 6 | 6 | 4 | 5 |

| Origin | 8 | 8 | 8 | 8 | 8 | 8 |

Role of Food Allergies/Limitations

Survey respondents were asked if they or any member in their household suffer from wheat/gluten intolerance, celiac disease, or avoids wheat/gluten for other reasons. This was done to see if consumers with these limitations, which certainly effect their choices and consumption of wheat products, found organic versions of wheat products appealing (see Table 3). As it turns out, in the case of bread, the percentage of respondents with limitations in terms of wheat/gluten consumption is significantly higher in the group of “very likely” organic consumers than in the other two groups. In the case of cookies, there are differences in the share of respondents with these limitations between the groups as well, but these were not significant. These results suggest those who need to or choose to avoid wheat/gluten products may likely be substituting regular wheat products with organic versions, as they are concentrated in the “very likely” group. However, it appears that this may hold for staple wheat products like bread, but less so for “optional” products, like cookies.

Table 3: Incidence of Food Allergies/Limitations (%)

| Allergy/Limitation | Bread | Cookies | ||||

|---|---|---|---|---|---|---|

| Very likely | Likely | Unlikely | Very likely | Likely | Unlikely | |

| Wheat intolerance/allergy | 0.21 | 0.04 | 0.05 | 0.27 | 0.15 | 0.06 |

| Wheat avoidance | 0.22 | 0.06 | 0.04 | 0.23 | 0.19 | 0.05 |

| Gluten intolerance/allergy | 0.19 | 0.07 | 0.06 | 0.13 | 0.13 | 0.08 |

| Gluten avoidance | 0.28 | 0.09 | 0.06 | 0.29 | 0.19 | 0.10 |

| Celiac disease | 0.04 | 0.01 | 0.01 | 0.02 | 0.04 | 0.01 |

Conclusions

Understanding the importance of various product characteristics, food labels, as well as consumer past purchase history and food allergies and other health concerns on organic food purchasing decisions can assist organic wheat producers, millers, and retailers in customizing products to meet the needs of a rapidly growing segment of consumers seeking organic foods.

On average “very likely” organic bread buyers find the natural, whole-grain, and organic labels very important in their purchase decisions. Non-GMO is also important to them. The “likely” and “unlikely” rated the natural label the highest for cookies and the whole grain label the highest for bread products. Information on product brand or origin was not important to any of the consumer groups, whereas taste and freshness were the clear winners. The “unlikely” organic consumers were the most price sensitive and were less concerned with product safety. Importantly, the results discussed here suggest those who need to or choose to avoid wheat/gluten products may likely be substituting regular wheat products with organic versions, illustrating the potential for organic products to fill the needs of these consumers.

References

- Organic Trade Association (OTA). 2017. “Robust Organic Sector Stays on Upward Climb, Posts New Records in U.S. Sales.” Press release. Available at: https://www.ota.com/news/press-releases/1968.

- U.S. Department of Agriculture, Economics Research Service (USDA-ERS). 2014. Organic Agriculture Overview. Online at: https://www.ers.usda.gov/topics/natural-resources-environment/organic-agriculture/.

Date Published: December 2018

Authors

Kynda R. Curtis, Professor and Extension Specialist, Department of Applied Economics; Tatiana Drugova, Graduate Research Assistant, Department of Applied Economics; Haylea Thomason, Small Farm Extension Marketing Intern, Department of Applied Economics

Related Research