Target Market Identification and Data Collection Methods

Introduction

It’s critical for any business to identify their primary consumer group, often referred to as the target market, as well as understand the target market’s needs and wants when developing a new product or service or when entering a new market outlet. Understanding the target market is helpful not only in the product development process, but also in the implementation of marketing plans, and in the selection of appropriate sales outlets. A detailed picture of the target market will assist in implementing effective and targeted promotion, catering to most valuable customers, designing new products which serve customer needs, selecting appropriate outlets for your products(s), and providing services and support your market needs/demands.

A target market is comprised of customers that have a need for a specific product or service and are willing to pay a profitable price for it. Every target market has unique characteristics that influence their choices as consumers. The demographics of a consumer describe their age, education level, income, etc. Psychographics include the hobbies, interests, and goals of the target market. It is also important to know the target market’s specific needs or preferences for a product, such as if it is organic, free-range or fair-trade (Kelley, 2016). There are a number of methods that can assist businesses in defining their target market(s). Primary research methods include consumer surveys, pricing trials, personal interviews, focus groups, etc. Secondary data provided by governmental agencies, consulting firms, etc. may take the place of primary data or further supplement it. The better a business defines their target market the more effective they will be in developing a valuable product and in implementing a successful promotion and marketing strategy. This fact sheet provided information on how to define a target market for a product or service, followed by methods for collecting data on targeted consumer groups.

Defining a Target Market

The first step in defining a target market is identifying its key characteristics such as demographics, psychographics, and products or services the target market wants and values. Evaluating each dimension of a consumer’s profile helps businesses identify the needs or gaps in the market. A demographic profile includes a customer’s age, location (state, county), gender, education level, income, children, marital status, etc. A psychographic profile describes the customer’s range of interests, hobbies and desires that influences their consumer choices. Knowing a customer’s psychographic profile is also helpful when selecting promotional methods as some customers may be apt to use specific magazines or publications, follow certain social media groups or participate in interest-specific online forums. This information can be difficult to obtain but is critical to understanding what customers care about regarding product traits like sustainability, safety, health, fair trade and worker-health.

Finally, it is important to know what kinds of products or services the target market wants and values. For instance, small-farm producers should know what produce varieties their customers want, and if they have any preferences regarding variety, packaging, delivery, location, ease of access, etc. Businesses can then move forward in creating and pricing a product or service that satisfies the consumer’s needs.

Consumer Data Collection

Collecting the information necessary to define a target market can be difficult given the scope of the market and the amount of data needed to paint an accurate picture of a specific population. Fortunately, a variety of survey methods can assist in collecting information from potential customers to create a target market profile.

Primary market research methods include surveying potential or existing customers, conducting general market assessment surveys, running product and/or pricing trials and researching competitors. Secondary resources like the USDA, marketing firms and university extension services have publications and data on past market studies and consumer consumption history that may be applicable (Curtis, Slocum, and Allen, 2015).

A consumer data collection plan might include both primary and secondary data. The plan should be thoughtfully developed to make sure that all critical information is collected and that the information is gathered in an efficient and effective way.

If the business has existing consumers, consumer data can be collected through the following:

- Past transactions, orders, and communications

- Online orders where name and contact info are provided, spending habits, user preferences, etc.

- Surveys at purchase, online, at events, etc.

- Customer appreciation events, or “disguised focus groups” where surveys may be conducted, or attendees can provide feedback on product samples, consumer observations can be conducted, etc.

- Competitions, where “To win” one must provide contact info and a few other details such as demographics or interests, etc.

Table 1 provides a list of information that could be collected and how it could be used by the business owner.

Table 1: Information to collect on existing consumers

| Customer information | Application for business owner |

|---|---|

| Name and contact information |

|

| Transaction history (What products do they buy? How much and how often do they buy them?) |

|

| Record of communication and responses |

|

| Demographic information (Age, location, education, etc.) |

|

| Psychographic information (Consumer interests, hobbies, concerns about health, food safety and the environment) |

|

| Spending habits (Thoughtful, impulsive or comparison shoppers) |

|

Customer or Market Assessment Surveys

For those business that don’t have an existing customer base, general market assessment surveys may be the best way to collect data on potential consumers and identify a target market for their new product or service.

Surveys are the commonly used method to collect consumer data. The different types of surveys have their own advantages and disadvantages, and thus the survey type chosen must best fit the consumer sample desired (Curtis, 2008). Below are considerations for various ways of conducting surveys. A summary of the advantages and disadvantages for each method are provided in Table 2.

Telephone surveys are conducted by calling individuals and asking them questions over the phone. These surveys can be effective because the interviewer is able to encourage the respondent to answer all the questions. Paying for telephone interviewers, however, is expensive and because of cell phones, people may ignore calls from unknown numbers.

Telephone surveys are conducted by calling individuals and asking them questions over the phone. These surveys can be effective because the interviewer is able to encourage the respondent to answer all the questions. Paying for telephone interviewers, however, is expensive and because of cell phones, people may ignore calls from unknown numbers.- In-person interviews are administered face-to-face. Similar to telephone surveys, interviewers can encourage respondents to complete the full survey and ask additional follow-up questions to clarify and expound on answers. In-person interviews are usually conducted in public places, making it easier to target specific populations such as vegetable producers at farmers markets or mothers at grocery stores. A disadvantage to this method is that some respondents feel uncomfortable revealing information about themselves to strangers. Additionally, permission is often required to conduct interviews in public areas and paying interviewers can be expensive.

- Internet surveys are conducted through online software. A letter, postcard or email is sent out inviting respondents to take the survey. Internet surveys can be advantageous because they can be completed faster than other survey types, are less expensive and results can be analyzed immediately. Some survey providers can also ensure that respondents answer all the questions and can even supply email listings of target audiences. Difficulties associated with internet surveys arise from the fact that the target group needs Internet access, thus excluding some populations.

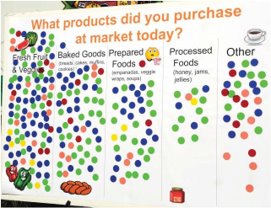

- Dot surveys or posters is a useful way to focus on just a few important questions. They are conducted by displaying a question (or several) with response categories and then asking respondents to place a sticker, or dot, in the category that correlates with their response. Dot surveys are fun, visual alternatives to written and oral surveys and their simplicity has been found to increase response rates compared to other survey types. Only a few questions should be asked at a time, however, and because respondents can see what other respondents have said, results may be skewed.

Table 2: Survey types with associated advantages and disadvantages

| Survey Type | Advantages | Disadvantages |

|---|---|---|

| Telephone surveys- conducted over the phone using randomized call list |

|

|

| In-person interviews- administered face to face |

|

|

| Internet surveys- respondents are invited to complete an online survey |

|

|

| Dot surveys- respondents place dots under category correlated to their response |

|

|

Other Data Collection Methods

Focus groups and observational studies are other research methods that allow businesses to more deeply understand consumer behavior and decision-making. In focus groups, a group of preselected target customers are asked a set of questions to assist in facilitating a discussion. Questions should explore the group’s motivations to buy certain products, specific concerns and existing problems they see in the market.

Observational studies focus on gaining immediate feedback through observing customers or asking for comments. They gauge consumer reaction to new products, flavors, packaging, product placement, etc. These studies can be conducted in a variety of ways.

Examples of observational studies include:

- Recording consumer behavior at grocery stores (where they look on shelves, move around the store, etc.)

- Offering free samples at farmers markets and asking for feedback

- Asking people to fill out comment cards about an event or service

Secondary Data Resources

To supplement the methods described above, businesses may be able to use existing research or published studies using related data. Government statistics and reports, consumer expenditures, and reports from trade associations, banks consumer panels and retail audits can be found online. The United States Department of Agriculture (USDA) and university Cooperative Extension have additional online databases with extensive agribusiness-related research.

Conclusions

This fact sheet provides information on how a business can define a target market for a new product or service, followed by methods which can be used to collect data on targeted consumer groups. Defining a target market is the first step in any new production development plan. A target market is defined primary by consumer group demographics, psychographics, and general product needs and wants. Businesses with a currently customer base can use a variety of techniques to fully understand their customers and more easily asses their needs. For those businesses that do not have a current customer base, collecting the needed data to identify a target market can be cumbersome, but there are a number of methods that can be employed depending on the data needed, collection budget, and time period. Consumer surveys are commonly used to collect consumer data but can be expensive and time consuming to conduct for an individual business. There are many governmental and private agencies that publish consumer data, much of which is free or provided at a low cost.

References

- Curtis, K., S. Slocum, and K. Allen, (2015). “Farm and Food Tourism: Exploring Opportunities.” Utah State University Extension Curriculum (Book, PowerPoint Presentations, and Worksheets). Online at: http://diverseag.org/htm/farm-and-food-tourism.

- Curtis, K.R., (2008). “Conducting Market Research Using Primary Data.” Chapter 7 of Niche Markets: Assessment & Strategy Development for Agriculture. A publication of the Western Extension Marketing Committee, UCED publication 2007/08-13.

- Kelley, K., (2016), “Understanding Your Customers: How Demographics and Psychographics Can Help.” Penn State University Extension. Online at: https://extension.psu.edu/understanding-your-customers-how-demographics-and-psychographics-can-help.

This material is based upon work supported by USDA/NIFA under Award Number 2015-49200-24225.

Date Published: December 2018

Authors

Kynda R. Curtis, Professor and Extension Specialist, Department of Applied Economics; Sierra Allen, Undergraduate Research Assistant, Department of Applied Economics

Related Research