Disaster Losses and Related Tax Rules

The dollar value of property losses due to fires, floods, tornadoes, earthquakes, lightning, freezes, etc. can be substantial. Federal income tax regulations often provide relief by allowing deductions for losses of business-use property.

Tax Issues Related to Debt Relief of Socially Disadvantaged Producers

The American Rescue Plan Act of 2021, H.R. 1319, was signed into law on March 11, 2021. The bill included the following provision “The Secretary shall provide a payment in an amount up to 120 percent of the outstanding indebtedness of each socially disadv...

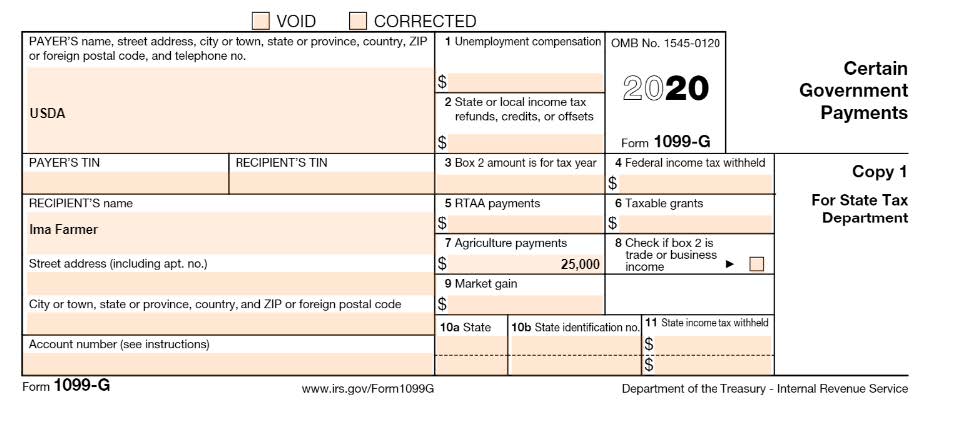

Taxability of the Coronavirus Food Assistance Program (CFAP) Payments

The Coronavirus Food Assistance Program (CFAP) was established to provide financial assistance to agricultural producers who have suffered a five percent or greater price decline, or who had losses due to market supply chain disruptions due to COVID-19, a...

Keepseagle Second Round Settlement Payment and Your Form 1099 Information Return

Receiving the second round of the settlement payment is the next step in finalizing a Keepseagle settlement. All settlement recipients will need to file a federal income tax return and report this settlement as income, regardless of current income level, ...

Tangible Property Regulations: Using the De Minimis Safe Harbor

In late 2013, the IRS issued new repair regulations that became effective as of January 1, 2014. Since the new repair regulations were issued, clarifying guidance has been and continues to be issued.

Employment of Family Members

The use of family labor in the farm or ranch operation can pose a number of challenges for farm managers as they try to sort through the vast quantity of regulations.

Estate and Gift Tax

Individuals may be subject to federal estate and gift taxes when large transfers of property, money, or other assets occur. Estate taxes apply to the transfer of assets (money and/or property) to one or more individuals when the owner dies. Gift taxes are...

Filing Dates and Estimated Tax Payments

When managing the cash flow of the farm or ranch, it is important to preserve cash as long as possible without incurring penalties or interest for late payments. The filing date of your federal income tax return is important, as payment can be a major exp...

Materially Participate in the Business to Avoid the Passive Activity Loss Rules

Beginning farmers and ranchers frequently start their agricultural businesses by beginning small and keeping their day jobs. These new business activities must meet certain threshold tests to be considered active rather than passive activities.

How Do the At-Risk Rules Apply to a Farm Business?

The majority of farm businesses will not be subject to the at-risk rules. However, when a business is subject to these rules, the deduction of losses will be limited to the amount that the producer has at risk.

Involuntary Conversion of Business Assets

During the course of operating a farm or ranch, operators will get rid of, lose, or dispose of property used in the business in a variety of ways. Sometimes events beyond the control of the business result in disposition of property.

Related Parties for Federal Income Tax Purposes

Taxpayers need to be aware of potential income tax consequences when dealing with related parties in business transactions. Specifically, the taxpayer must identify the potentially related party and the tax issue that may apply relative to both the taxpay...

Estate Planning

No matter your age, as a landowner, a business person, or simply a homeowner with valuables you want to go to someone special, you should be concerned about the future of your business or the distribution of the property in question to the right individua...

W-2s for Foreign Agricultural Workers

The Internal Revenue Service (IRS) clarified reporting requirements for employers of foreign agricultural workers temporarily in the United States on H-2A visas with an announcement in September 2011. Employers of foreign agricultural workers on an H-2A v...

Prepaid Farm Expenses

Farmers and ranchers often pay for feed, supplies, fertilizer, and other inputs in one year and use those items in the following year. They may do so to pay lower prices, guarantee availability, for planning purposes, and/or other reasons.

Basis

Basis is a short version of the term ‘Adjusted Tax Basis.’ Basis measures an owner’s investment in an asset. Usually basis decreases each year by the amount of depreciation taken on the asset.

Conservation-Related Payments and Expenditures

Concerns about soil erosion, air and water quality, wildlife habitat and environmental protection have resulted in the rapid expansion of conservation-related programs. Generally, the benefits associated with these conservation programs accrue to society ...

2012 Federal Tax Forms Used by Beginning Farmers and Ranchers

This article provides a list of business and personal tax forms and schedules which farmers and ranchers may experience when filing their annual income tax return. This publication does NOT cover the rules that apply for each of these forms. For a more co...

What is Farming? Does Reporting Matter?

Many rural families combine a number of economic activities to generate additional family income. Farm production activities may be combined with full-time employment in farming or in the non-farm sector. Part-time employment may involve several seasonal ...

Lease vs. Purchase of Machinery

Leasing or purchasing of machinery and equipment represent alternative ways for farm operators to acquire assets for agricultural production. Leasing has increased in popularity with agricultural producers. Manufacturers and financial institutions view le...

Alternative Minimum Tax

Congress imposes the alternative minimum tax (AMT) on taxpayers to prevent them from combining several tax exclusions, deductions, and credits to pay very little or no federal income tax even though they have significant income.

Net Operating Losses

Weather, disease, and variable prices for inputs and commodities cause farmers’ income to fluctuate from one year to the next. Farmers can minimize their income tax liability by managing the timing of their income and deductions to keep their taxable inco...

Depreciation Fact Sheets

Topics covered include Class Life, Cost Recovery, Rules on Automobiles and Listed Property, Expensing Qualifying Assets, Bonus First-Year Depreciation, Minimum Tax Considerations, Home Office, and Expensing Options

Like-Kind Exchange (Trade) of Business Assets

The purpose of this discussion is to illustrate correct income tax reporting procedures when business properties are disposed of over the course of time through like-kind exchanges.

Sale of Business Property

During the course of operating a farm or ranch business, producers will dispose of property (e.g., livestock, equipment, real estate, etc.) used in the business. This can occur in a variety of ways with two common methods being sales of assets and trading...