Taxability of the Coronavirus Food Assistance Program (CFAP) Payments

1Ruby Ward, 2Trent Teegerstrom, and 3JC Hobbs

1Extension Economist & Professor, Utah State University

2Specialist & Associate Director of Tribal Extension Program, University of Arizona

3Associate Extension Specialist, Oklahoma State University

Introduction

All CFAP Recipients Must File a Tax Return

The Coronavirus Food Assistance Program (CFAP) was established to provide financial assistance to agricultural producers who have suffered a five percent or greater price decline, or who had losses due to market supply chain disruptions due to COVID-19, and possibly face additional and significant marketing costs. The purpose of the payment is to replace the reduced or lost income from adverse price declines and market disruptions. These payments are included in gross farm income in the year that they are received.

All settlement recipients will need to file a federal income tax return and report this settlement as income regardless of their current income level, land status, current employment status, and even if they have not filed a federal income tax return before. Each CFAP recipient will receive a Form 1099-G. Recipients must file a tax return to comply with IRS regulations.

This article is intended to cover the most common actions each CFAP recipient will need to take once the Form 1099 has been received. This information is intended for educational purposes only. Seek the advice of your tax professional regarding the application of these general principles to your individual circumstances.

Note. All recipients of the Coronavirus Food Assistance Program payment will need to file a federal income tax return reporting this payment as income, regardless of their current income level, land status, current employment status, and even if they have not filed an income tax return before. Failure to file a return with the correct income included could result in additional amounts owed to the IRS for interest and penalties. Recipients may qualify for a tax refund. You will not be able to receive a tax refund if a return is not filed.

Form 1099 Informational Returns

The 1099 tax forms are informational forms used to report various types of income (other than wages, salaries, and tips). For each form filed, one copy is sent to the Internal Revenue Service (IRS) and another copy to the recipient of the payment. The IRS will then look for and match the amounts from the Form 1099 to make sure they were reported on the recipient’s federal tax return.

Although there are several common 1099 forms used for IRS tax reporting purposes, the focus of this article will be Form 1099-G. Form 1099-G is used to report government payments.

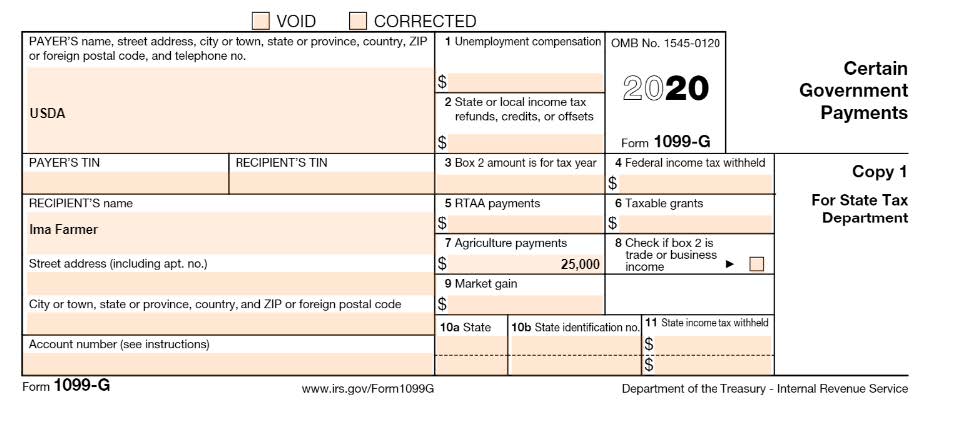

Reporting CFAP Payments on Form 1099-G

The Form 1099-G will include the total payment amount received under the CFAP program in Box 7 (Agriculture payments). The amount from Box 3 will be included in your income. This will increase your taxable income and income tax owed. However, since the payment was based on market losses, your actual taxable income and tax owed, if any, may actually be lower than in prior years.

Note. The Form 1099-G received will include the total amount paid to the recipient that was received in 2020.

Example 1 Part 1: : Ima Farmer qualified for and received a CFAP payment. Ima receives a check for $25,000 in 2020. Ima receives a 1099- G showing $25,000 in Box 7 “Agriculture payments”.

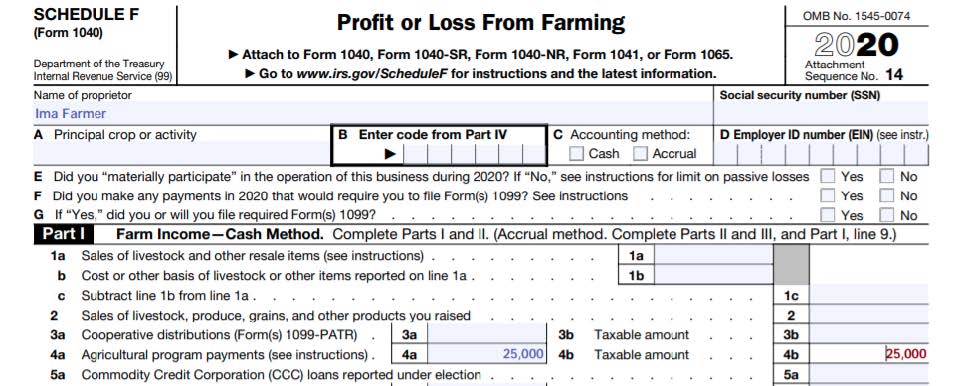

You will report the full amount from Form 1099-G Box 7 “Agriculture payments” on Line 4b: Agriculture program payments of Schedule F (Form 1040), Profit or Loss From Farming, as shown below. Remember that this payment is taxable and must be reported on the tax return. In addition, it is subject to self-employment tax.

Note. Although in some cases farm income derived from trust land may be exempt (Rev. Rul. 56-342, 1956- 2 C. B. 20), it is still necessary to file a return with the amount from the 1099-G on a Schedule F (Form 1040). You are encouraged to seek professional assistance in filing these tax returns.

Example 1 Part 2: After receiving the Form 1099-G seen in Example 1 Part 1 (above), Ima files a tax return showing the amount from Box 7 Form 1099-G as “Agriculture Payments” on Line4a and 4b: Agriculture Program Payments of Schedule F (Form 1040), Profit or Loss from Farming.

IRS Publications

More information on these and other Form 1099s can be found in “A Guide to Information Returns” on the IRS website at www.irs.gov. Enter “A Guide to Information Returns” in the search box in the top right-hand portion of the page. Detailed information on specific Form 1099s can also be found by entering the form name (ex. “Form 1099-G”) in the search box. The search results will include the specified form, and instructions for completing the form.

Additional Topics

This fact sheet was written as part of Rural Tax Education, a national effort including Cooperative Extension programs at participating land-grant universities to provide income tax education materials to farmers, ranchers, and other agricultural producers. For a list of universities involved, other fact sheets, and additional information related to agricultural income tax, please see RuralTax.org. A related article that might be helpful is “Form 1099 Informational Returns”

Published March 2021