Start-Up Costs: Correct Reporting by Farmers for Income Tax Purposes

Guido van der Hoeven, Extension Specialist / Senior Lecturer Emeritus

Department of Agricultural and Resource Economics, North Carolina State University

Introduction

Income tax rules apply to expenses that are incurred and paid before a business exists. These expenses are referred to as “start-up expenditures” or “start-up costs.” The IRS provides guidance relative to the deductibility of these start-up costs for any individual or entity beginning a new business, such as a farm. These rules apply regardless of the nature of the business, or the organizational structure ultimately used in operating the new business. A challenge for the beginning business owner is to identify the “start date” of the business. Expenses incurred prior to the start date are generally considered start-up expenses, to which the IRS rules apply as found in IRC § 195.

Starting Date of Business Activities

For some businesses, the start date is easy to determine. In the case of a corporation, the filing and recognition date by a state’s Secretary of State (or other such office) may be used to pinpoint an entity’s beginnings. For the sole proprietor, a farmer for example, there may also be such a date, which may be the day a request for a federal identification number in the name of the proprietor or business occurs. Frequently, though, start-up may begin over an extended period. Another specific date which may be considered is the date of the first tillage operation for a first crop, such as fall disking or fertilizer application. The business operator must therefore begin to account for costs that may become start-up expenses for that business prior to operation. Unfortunately, there is no bright-line test in the Internal Revenue Code or regulations for agricultural businesses. Courts have looked to facts and circumstances of a business to determine a start date; frequently, the fact pattern is such that when the business begins to “operate” and conduct activities for which it was organized, is when the business starts.

Start-Up Costs and Starting Date of Business Activities

The IRS general rule for start-up expenses states that start-up expenses must be amortized and cannot be deducted as an ordinary business expense unless the farmer, in this case, elects to expense up to $5,000 (for tax years beginning in 2011 and beyond) with this cap being reduced, dollar for dollar, for start-up expenses exceeding $50,000 for the year in which the business begins. Any excess cost remaining is to be ratably deducted (amortized) over 15 years (180 months).

What Are Start-Up Costs?

To answer this question, the beginning farmer needs to be honest with him- or herself about when the business began, and then account for costs incurred prior to that date. Examples of broad categories that may be treated as start-up costs that are paid in connection with beginning a business include:

- Investigating the “creation, acquisition, or establishment of an active trade or business” such as a farm. However, once the individual farmer has decided to enter into the business of farming or made the decision about which type of farm, the expenses may be treated as ordinary and necessary to that business and may be deducted.

- Creating a farm business (e.g., registration costs for a farm name, organizational costs for a business entity)

- Any activity (costs incurred) engaged with a profit motive or for the production of income before the active trade of farming begins with the intent of active farming.

The IRS provides further guidance to help beginning farmers identify these costs by allowing that a start-up cost is an expense that, if the business were in full operation, would be allowed as an ordinary and necessary business expense and would be deductible during a business tax year, such as fall or spring tillage or burn-down herbicide application for no-till farming.

However, the IRS provides that some costs may be currently deducted under other rules and not subject to the start-up cost limitations. For example, costs such as organizational costs to create an entity (e.g., an LLC), business interest expenses, taxes paid to other jurisdictions (e.g., property tax), or research and experimental costs may be deducted under these other rules.

Making the Election to Expense or Amortize Start-Up Costs

If the farmer, maybe unknowingly, deducts start-up expenses on his or her IRS Schedule F as a business deduction, the IRS presumes that the farmer has elected to deduct or expense the start-up costs. Upon a review in the future of this year’s tax return, an adjustment will be made if it is determined that the start-up costs exceeded $5,000 and the excess should have been amortized. This illustrates that the election may be made in a “messy” manner.

The IRS requires that the beginning farmer attach a statement to a timely filed income tax return to make this election. The statement should include the following:

- Description of trade or business (e.g., “Happy Hollow Farm”);

- Sufficient detail of the expenses incurred and treated as start-up costs;

- Identification of the taxable year to which the election applies;

- Identification of any future years to which the election may apply;

- Statement that the amortized expenses, if any, are amortized for 180 months;

- Date that the business began.

If, at a later date, the farmer discovers that changes need to be made or additional expenses should have been treated as start-up expenses, a revised statement may be attached to a subsequent income tax return of the business. Additionally, an IRS Form 3115, Change in Method of Accounting, may be required to be filed.

Example 1: Shirley wants to provide local consumers with wholesome seasonal vegetables and cut flowers. She enjoys gardening as a pastime, but with each succeeding season she wondered if there was an opportunity to create a business from her hobby. Shirley began to investigate the possibilities through research and attending county extension and organic producer meetings. Shirley, having worked as a bookkeeper, keeps track of her expenses: meeting and conference registrations, $2,650; allowable mileage, lodging, and meal expenses, $1,250; legal expenses to register business name and organize as a limited liability company (LLC), $1,350; internet and webpage creation for business, $1,500; research material (books and accounting programs), $450; and miscellaneous expenses, $325. After a period of 18 investigative months, she begins her business, Shirley’s Veggie and Flower Farm, LLC, on March 1, 20xx (the LLC has a single member and is treated as a disregarded entity for tax purposes, meaning that Shirley will file a Schedule F). The total of allocable start-up expenses she paid prior to March 1 (20xx) is $6,175; the $1,350 organizational fees are amortized under IRC § 709.

Shirley elects to expense the maximum amount of start-up expenses and amortized the balance over 180 months. She attaches an election statement to her 20xx federal income tax return. The election statement is illustrated below.

Election Statement

Shirley's Veggie and Flower Farm, LLC

EIN 52-20120001

Elected, under IRC § 195 and Treasury Regulation § 1.195-1(c), to expense start-up costs of $5,000 and amortize the excess over $5,000 for 180 months. This business began March 1, 20xx. The business is an organic vegetable and flower farm. The election is for the calendar tax year of 20xx.

Start-up costs:

| Meetings and conferences | $2,650 |

| Mileage, lodging and meals | $1,250 |

| Webpage design | $1,500 |

| Research material | $450 |

| Miscellaneous | $325 |

| Total start-up costs | $6,175 |

Elected cost to expense: $5,000

Amortized cost over 180 months: $1,175, a per month expense of $6.53 (For year 20xx, $65)

Reporting

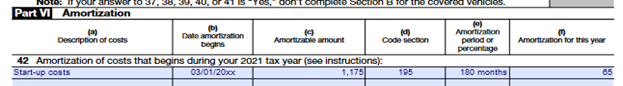

Shirley reports the $5,000 of expenses taken in the current tax year on line 32a of her Schedule F for the LLC. The amortized expenses, $65 for tax year 20xx, is reported on IRS Form 4562, Depreciation and Amortization, Part VI, Line 42 to become part of the total expense.

Schedule F for 20xx

Form 4562 for 20xx, the annual amortization will be reported in subsequent years.

If Shirley ceases business before recovering her $1,175 of amortized costs, she may deduct any remainder on her final business return.

Failed Searches

A non-corporate taxpayer may not deduct any costs that result from an unsuccessful business search. However, if an alternate business is started, the former start-up costs may be deducted as a business or investment loss under Code Section 165.

IRS Publications

Additional information concerning business start-up costs can be found in Chapter 7 of IRS Publication 535: Business Expenses.

To access IRS forms and publications, go to www.irs.gov and click on “Forms and Publications.” Then click on “Publication number” under “Download forms and publications by.” Type the publication number in the find box to search for the publication. Publications may be viewed online or downloaded by double clicking on the publication.

Additional Topics

This fact sheet was written as part of Rural Tax Education, a national effort including Cooperative Extension programs at participating land-grant universities to provide income tax education materials to farmers, ranchers, and other agricultural producers. For a list of universities involved, other fact sheets, and additional information related to agricultural income tax, please see RuralTax.org.

This information is intended for educational purposes only. You are encouraged to seek the advice of your tax or legal advisor, or other authoritative sources, regarding the application of these general tax principles to your individual circumstances. Pursuant to Treasury Department (IRS) Circular 230 Regulations, any federal tax advice contained here is not intended or written to be used, and may not be used, for the purpose of avoiding tax-related penalties or promoting, marketing or recommending to another party any tax-related matters addressed herein.

USDA is an equal opportunity provider, employer, and lender. Rural Tax Education is part of the National Farm Income Tax Extension Committee. The land-grant universities involved in Rural Tax Education are affirmative action/equal opportunity institutions.

This material is based upon work supported by the U.S. Department of Agriculture, under agreement number FSA21CPT0012032. Any opinions, findings, conclusions, or recommendations expressed in this publication are those of the author(s) and do not necessarily reflect the views of the U.S. Department of Agriculture. In addition, any reference to specific brands or types of products or services does not constitute or imply an endorsement by the U.S. Department of Agriculture for those products or services.

Published November 2022