Government Payments: Form 1099-G

Guido van der Hoeven, Extension Specialist / Senior Lecturer Emeritus

Department of Agricultural and Resource Economics, North Carolina State University

Introduction

Farmers and ranchers receive various government payments from USDA and state agencies. These payments can be made as direct payments for commodity programs (e.g., corn, soybeans, and wheat) or for specific public policy goals, such as conservation of soil and water. Between 2020 and 2022, there were ad hoc relief payments created by Congress to address the COVID-19 pandemic. Recently, USDA reports that nearly 65 percent of all farmers received some level of government payment to support agricultural activities and public policy. Generally, these payments are reported on an IRS Form 1099-G, which is an informational document used to report these payments by the remitting agency to the IRS, with the requirement that the recipient report the payment on their income tax return.

In some cases, the government payment may be excluded from taxable income. The farmer’s or rancher’s business records are used to determine such an exclusion of income.

This fact sheet reviews the IRS Form 1099-G and provides examples of various federal government programs which may be reported to farmers and ranchers over the course of their respective business operations. The examples provide guidance for the correct reporting of these payments. Additionally, situations exist in which the farm/ranch business records need to be clear as to the income tax treatment that applies to a specific program payment.

IRS Form 1099-G

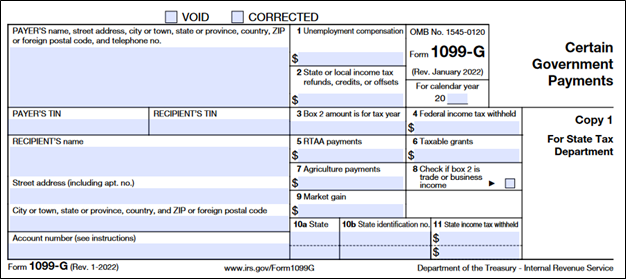

The informational return, Form 1099-G, Certain Government Payments, is used to report to a taxpayer the amount which was received during the applicable tax year. Generally, these forms arrive in the taxpayer’s mailbox by the end of January for the previous tax year. Figure 1 below is an example of Form 1099-G. This form was most recently updated in January 2022.

Note that the left-hand side of the form is where information for both the Payer and the Recipient is found. This includes names, addresses and Tax Identification Numbers (TIN). On the right-hand side, there are 11 numbered boxes for specific payment reporting by government agencies. There is one box which denotes the tax year for which the Form 1099-G is being issued.

For the purposes of this fact sheet the discussion will focus on Box 6, Taxable Grants; Box 7, Agriculture Payments; and Box 9, Market Gain, which are most commonly used to report government payments to a farming or ranching business.

Box 2, State or local income tax refunds, credits, or offsets, might be received by a farmer or rancher to report an income tax refund. However, it must be determined if, in the preceding income tax year, the farmer or rancher itemized his/her personal deductions; if so, then the tax refund is included in the subsequent year’s income.

Figure 1. Form 1099-G, Certain Government Payments

USDA Government Payments

Table 1 (below) lists many of the government programs which make payments to farmers, ranchers and fishermen to help with farm and ranch economic stability.

Table 1. List of USDA Government Programs

|

Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC) |

Conservation Programs · Conservation Reserve Payments (CRP) · Wetlands Reserve Payments (WRP) |

|

Biomass Crop Assistance Program (BCAP) |

Dairy Margin Coverage Program (DMC) |

|

Loan Deficiency Payment Program (LDP) |

Marketing Assistance Loan (MAL) |

|

Market Loan Gains (MLG) These values are reported if CCC loans are repaid at less than the original borrowed amount. |

Cost Share Programs · Loss of Buildings · Livestock Provisions |

|

Market Facilitation Program (MFP) |

Corona Virus Assistance Program (CFAP) 1 & 2 |

|

Seafood Trade Relief Program (STRP) |

Pandemic Livestock Indemnity Program (PLIP) |

|

Emergency Relief Program (ERP) |

Emergency Livestock Relief Program (ELRP) |

|

Other ad hoc programs as needed |

Spot Market Hog Pandemic Program (SMHPP) |

The list in Table 1 is not all inclusive; however, it is provided to illustrate the variety of programs which can be “hard line” items in the Farm Bill or can be additional support due to unforeseen circumstances, such as the recent COVID-19 pandemic programs (CFAP, ERP, and ELRP, for example). Generally, when the payment is made to the producer (commonly by direct payment to a designated bank account), a letter or notification is provided that states which program the payment is made under, and this should be recorded in the business’ records. If needed, the local Farm Service Agency (FSA) office can provide a detailed payment listing on the producer’s account. Thus, the reporting may be a single dollar amount in Box 7 of Form 1099-G, Agriculture Payments.

Example 1:

Ralph operates a diversified crop and livestock farm. This year Ralph receives USDA Program payments from three sources: Direct payments of $35,000 under ARC, Cost share payments of $15,000 to improve riparian zones and install water troughs for his cattle, and finally, $40,000 in CRP payments for planting cover crops on highly erodible land and retiring that land for a contracted period. The total value reported in Box 7 of his Form 1099-G was $90,000. Ralph reports this $90,000 of USDA payments on Lines 4a and 4b, Agricultural Program Payments, of his Schedule F, Profit or Loss from Farming.

Example 2:

Rosa operates a wheat farm in the Palouse area of the United States. Rosa receives $25,000 of cost-share payments to implement water conservation practices on her farm. Her gross farm income is $500,000 and she spends a total of $40,000 to implement the water conservation practices. Because the $40,000 spent is less than 25 percent of her gross income from farming, she can deduct the entire amount on her Schedule F, Line 12, Conservation Expenses. Rosa reports the $25,000 of conservation payments received on Lines 4a and 4b, Agriculture Program Payments, of her Schedule F.

Example 3:

Suzy operates a corn and soybean farm. Last year she took out a Commodity Credit Corporation (CCC) loan for $100,000 on some of her corn. She chooses to treat the loan as a loan. In the subsequent year, when the posted county price was below her loan price per bushel, she repaid the loan in full at $95,000 of value. This creates a market gain of $5,000 for Suzy. USDA reports this market gain in Box 9 of Form 1099-G, which is reportable on Lines 4a and 4b of her Schedule F.

Example 4:

Using the same fact pattern as Suzy in Example 3, changing only that Suzy elects under Internal Revenue Code (IRC) section 77 to treat her loan as income. In this case, she reports the $100,000 of the loan as farm income on Line 5a of her Schedule F. When she repays the loan to the CCC of $95,000, $5,000 has already been included in her income when she reported the $100,000. Thus, she needs to adjust her government payments by $5,000, which USDA would report in Box 9 as a market gain. If, for example, Suzy’s total 1099-G reported $50,000, the combination of Boxes 7 and 9 on Line 4a of Schedule F; she reports $45,000 on Line 4b to prevent double counting of the reported $5,000 market gain per USDA’s records, but not per her accounting records.

Excluding Government Payments from Taxation

Sometimes conservation programs will provide significant payments to producers to implement a water conservation program for the public good. These payments are generally made for non-depreciable water control structures and these improvements to the land do not add any measurable value to the farmland. Under IRC § 126, there is a methodology to exclude these payments from income. The calculation is complex and is beyond the scope of this article. Competent tax advice is strongly recommended. Chapter 5, Soil and Water Conservation Expenses, in the Farmer’s Tax Guide (IRS Publication 225), has more detailed information which can help producers and their advisers make decisions about the tax treatment of these payments.

State Government Payments

State Departments of Agriculture or Environment may have programs which provide payments to farmers as incentives to implement cultural practices for environmental or other recognized public policy goals. Typically, payments are made to farmers and ranchers in the form of grants. Because these payments are generally made to producers while operating a farming trade or business, these payments are taxable under Internal Revenue Code § 61. The state agency which issues the payment(s) will, at the close of the tax year, issue a Form 1099-G with the value of the grant listed in Box 6, Taxable Grants.

Example 5:

Juan manages a citrus farm in south Texas. As part of a broad soil and water conservation project in a major river valley, Juan receives a grant of $40,000 to build diversion water races and grass waterways with the purpose of collecting water to percolate into the underlying aquifer. After the close of the tax year, the Texas Department of Agriculture issues a Form 1099-G with Box 6 populated with the value of $40,000 for the grant Juan received. Juan reports the amount of the grant on Lines 4a and 4b of his Schedule F.

Summary

Farmers and ranchers should keep detailed records of the various government programs in which they participate. Payments are generally fully taxable to the recipient. However, under the IRC and Treasury Regulations, some or all the payments may be offset by a deduction (soil and water conservation expenses) subject to a limit or the payment may be excluded from income. Therefore, it is imperative that the tax professional assisting the producer be fully aware of the business model and the intent of the farmer when giving tax advice and managing the income and self-employment tax liability of the farm business.

IRS Publications

To access IRS forms and publications, go to www.irs.gov and click on “Forms and Publications.” Then click on “Publication number” under “Download forms and publications by.” Type the publication number in the find box to search for the publication. Publications may be viewed online or downloaded by double clicking on the publication.

Other Resource

The USDA Programs can be found at https://www.fsa.usda.gov/programs-and-services/payment-eligibility/index

Additional Topics

This fact sheet was written as part of Rural Tax Education, a national effort including Cooperative Extension programs at participating land-grant universities to provide income tax education materials to farmers, ranchers, and other agricultural producers. For a list of universities involved, other fact sheets, and additional information related to agricultural income tax, please see RuralTax.org.

This information is intended for educational purposes only. You are encouraged to seek the advice of your tax or legal advisor, or other authoritative sources, regarding the application of these general tax principles to your individual circumstances. Pursuant to Treasury Department (IRS) Circular 230 Regulations, any federal tax advice contained here is not intended or written to be used, and may not be used, for the purpose of avoiding tax-related penalties or promoting, marketing or recommending to another party any tax-related matters addressed herein.

USDA is an equal opportunity provider, employer, and lender. Rural Tax Education is part of the National Farm Income Tax Extension Committee. The land-grant universities involved in Rural Tax Education are affirmative action/equal opportunity institutions.

This material is based upon work supported by the U.S. Department of Agriculture, under agreement number FSA21CPT0012032. Any opinions, findings, conclusions, or recommendations expressed in this publication are those of the author(s) and do not necessarily reflect the views of the U.S. Department of Agriculture. In addition, any reference to specific brands or types of products or services does not constitute or imply an endorsement by the U.S. Department of Agriculture for those products or services.

Published April 2023