Farm Loan Immediate Relief Under Inflation Reduction Act: Income Tax Options Triggered by Corrected 1099s

Guido van der Hoeven

Extension Specialist/Senior Lecturer Emeritus, North Carolina State University

Introduction

The Inflation Reduction Act (IRA) of 2022 (Public Law 117-169) was signed by the President on August 16, 2022. IRA in Section 22006, Farm Loan Immediate Relief for Borrowers With At-Risk Agricultural Operations, provided debt relief. Further, Section 22008, repealed the Farm Loan Assistance Section 1005 of the American Rescue Plan of 2021 (ARP). The Act provides $3.1 billion to be made available through Sept. 30, 2031, to deliver assistance through the USDA Farm Service Agency (FSA) to help producers become current with their direct or guaranteed FSA loans. The Secretary of Agriculture was to determine how the program would be initiated and program funds to be disbursed.

This publication presents the basics of the 2022 program (additional information may be forthcoming), the tax consequences, tax management methods to consider, and farm management considerations. Additionally, this publication updates, with possible options to consider, decisions that farmers and ranchers will need to address in light of corrected 1099s discussed below.

Program Basics

Through the initial payments in October 2022, the Farm Service Agency (FSA) has provided nearly $600 million in relief to approximately 11,000 borrowers who were 60 or more days delinquent on their FSA direct or guaranteed loan as of September 30, 2022. For direct loan borrowers, this took the form of payments to make their loans current and to cover their next annual installment. For guaranteed borrowers, these payments were equal to the amount the borrower was delinquent as reported in their most recent report from their lender.

FSA has also provided just more than $200 million in payments to resolve the remaining debts for approximately 2,100 borrowers who had their loan collateral liquidated but had remaining debt that was due to be referred to the Department of Treasury for offset or collections. Payments to these borrowers resolved the remaining outstanding debt.

FSA also administered $66 million in separate automatic payments, using COVID-19 pandemic relief funds, to support up to 7,000 direct loans for up to 3,000 borrowers who used FSA’s disaster-set-aside option during the pandemic to move their scheduled payments to the end of their loans.

FSA continues to provide case-by-case processes for approximately 1,600 complex accounts including those with pending foreclosure, bankruptcy, or court actions.

Borrowers who received program benefits received a letter from the USDA FSA stating either that a program payment was made and was directly applied to the loan, or received a check made out to them and the lender to apply to the loan. Borrowers with direct loans with FSA did not receive a check themselves; they had the amount directly applied to their loan balance. Farmers who benefited from this program received a 1099-G (Certain Government Payments) which was issued in January 2023. However, corrected 1099-Gs and a new 1099-C (Cancellation of Debt) were issued in April of 2023 to some farmers and ranchers. These corrected 1099s provide income tax management opportunities which are discussed later in this fact sheet.

Income Tax Consequences of Newly Issues 1099s

The Inflation Reduction Act does not make provision for these loan payments to be excluded from taxation.

Through negotiations by USDA, the IRS, and the Department of Treasury, these ad hoc government payments were re-characterized as cancellation of debt (COD). Farmers and ranchers who benefited from Section 22006 of IRA are now able, in some cases, to recognize these payments as being excluded from income under IRC section 108. This is a significant change in policy interpretation; thus, the tax implications may be different on individual circumstances. There are differences between being a direct FSA borrower and being a participant in FSA guaranteed loan with a commercial bank.

Direct Borrowers

Farmers and ranchers who had direct loans with FSA and were more than 60 days in arrears making payments on their loans received payments which brought them current on principal and interest. The originally issued 1099-G treated these IRA payments as “ad hoc” USDA payments subject to income and self-employment tax. However, with the re-characterization of these payments as COD, in some cases these payments are not subject to tax.

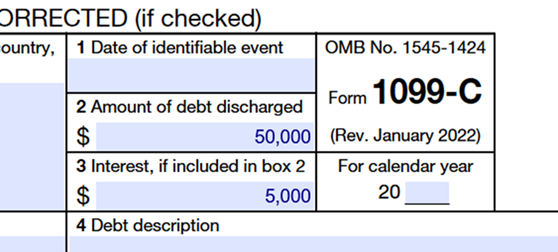

Example 1: Rob operates a diversified farm. In September of 2022, Rob was $50,000 behind on his FSA direct loan, comprised of $45,000 in principal and $5,000 interest. Under IRA, Rob received a payment, made on his behalf, to bring his loan current. Subsequently, in January of 2023, Rob received a 1099-G for $50,000 as an ad hoc government payment. In April 2023, Rob received a corrected 1099-G for $0 and a 1099-C for $50,000.

Exclusion of COD under IRC 108

Under IRC section 108 there are several provisions which allow farmers and ranchers to exclude or defer cancellation of debt from gross income on their current income tax returns. For FSA direct loan borrowers, two of the exclusions may apply; these are insolvency and qualified farm indebtedness. The first step is to consider interest (as illustrated in Example 1). Under section 108, farmers and ranchers don’t recognize income from discharge of indebtedness if the payment of that debt would have entitled to the farmer to a deductible expense. Thus, the COD for any part of the debt which arises from interest is not income.

Example 2: Rob (from Example 1) received a 1099-C with Box 2 showing the total amount discharged as $50,000, the amount of accrued interest as part of the discharged debt should be reported in Box 3 as $5,000. This is illustrated below in the partial 1099-C.

After consideration of the accrued interest which was forgiven, the farmer or rancher needs to determine if the insolvency or qualified farm indebtedness rules apply. Professional tax advice is strongly recommended to evaluate the optimal outcome of this re-characterization of these USDA ad hoc IRA payments.

Borrowers with a Guaranteed Loan

For farmers and ranchers who had FSA guaranteed loans with commercial banks, the rules are slightly different. These IRA payments are not treated as COD because the commercial bank did not forgive the guaranteed debt. These guaranteed loans were brought current as of September 30, 2022. These payments are ad hoc, and are reported on Form 1099-G.

These payments are taxable for income tax purposes and subject to Self-Employment (SE) Tax. The program payment is treated as ordinary earned income, which will be taxed at your individual income tax rate plus a 15.3% SE Tax. The SE tax is made up of 12.4% for Social Security on the first $147,000 (for the 2022 tax year), and 2.9% (on 100% of the income). It is possible that an additional 0.9% Medicare tax will be triggered above a threshold amount ($250,000 for Married Filing Jointly and $200,000 for Single filers). The program payment for many borrowers will cover a principal payment and an interest payment.

Example 3, Eli’s Eel Farm: Eli is married and files a joint tax return using the standard deduction of $25,900. Eli was in arrears $100,000. USDA provided an IRA payment of $100,000 for Eli’s Guaranteed Loans. Eli has no farm profit this year, therefore the $100,000 is treated as income subject to SE tax. Eli may owe as much as $8,478 in federal income tax and $15,300 of SE tax dependent on individual credits, other deductions, etc. for a total of $23,778. Dependent on the state Eli lives in, there may also be income taxes owed at the state and local municipal level as well. Eli lives in South Carolina so there could be up to an additional $7,000 in state income tax owed. Since Eli received the program payment, he may owe as much as almost $30,000 in taxes from the $100,000 program payment.

Tax Management Options of Re-Characterized IRA Payments

With the re-characterization in the spring of 2023 of these 2022 IRA payments to the farmers and ranchers who are direct or guaranteed loan borrowers, it is imperative that the borrower meets with their tax/legal professional to discuss tax management strategies. The farmer or rancher may need to file an amended return if their original 2022 IRS Form 1040 was filed prior to this new information.

Farmers and ranchers who had direct FSA loan debt relief through the IRA payments, and who have filed their tax return prior to receiving a corrected 1099-G and new 1099-C, have the following options:

- Contact their tax professional and provide them with the new 1099s and the cover letter which came with the 1099s. The letter is very important as it explains the reason for the forms and the options available.

- If the farmer or rancher determines that they do not qualify or do not wish to exclude this discharge of debt from income, amending the filed returns is not needed. The IRS is aware of this issue and will not require an amended tax return for this 1099-C.

- If the farmer or rancher determines that they do qualify for some exclusion of the discharge of indebtedness from income, the farmer or rancher may file an amended return, including the proper forms, to exclude the income.

For farmers and ranchers who filed an extension for their 2022 income tax return, they should:

- Work with their tax professionals and provide them with the new forms and the cover letter.

- Should determine whether they qualify for relief.

- File the extended tax return, which will be due October 16, 2023.

For guaranteed loan borrowers, separate tax management strategies may need to be considered to reduce the tax consequence of the debt relief of these IRA payments. A few options to consider are listed below.

Depreciation

Depreciation will offset some of the tax liability if there is any carry-over depreciation available or if there have been any capital asset purchases made during the tax year the program payment was received. Be careful of using Section 179 or bonus depreciation at too high of a level, as it will decrease future carry-over depreciation to offset future income.

Net Operating Loss

Producers who have any remaining carryover Net Operating Loss(es) (NOL) may use these to offset taxable income up to 80% of the total taxable income for the year. If taxable income is $100,000 for the year, and if the borrower has $250,000 of NOL’s, only $80,000 will be able to be applied, leaving $20,000 of taxable income.

Income Averaging (Schedule J)

Income averaging is a tax management strategy only available to farmers and commercial fishermen. Income averaging allows a taxpayer to take some of the income from this tax year and apply it to the three previous years income tax brackets. This can be advantageous if the taxpayer is in a higher income tax bracket this year than in the three previous years. Farmers and ranchers who have guaranteed loans through FSA and who received IRA payments which increased farm income may benefit from income averaging.

Example 4, Jennifer Ann’s Berry Farm: Jennifer Ann is married and files jointly. In 2022, Jennifer Ann has received an IRA payment on her guaranteed loan resulting in a higher-than-normal tax bracket for her at 35%. Normally, she is in the 12% income tax bracket. Because of this, she should consider Income Averaging. She is going to take $180,000 of this year’s income to be applied to lower unused income tax brackets in the previous three years. The Internal Revenue Code (IRC) requires that the amount of income from this year to be applied to each of the three previous years must be split evenly to the three previous years’ brackets. The $180,000 will be divided by “3” which equals $60,000 ( = $60,000) that will be applied in each of the previous three tax years at lower income tax brackets that are available. This can be beneficial to many farmers for tax purposes. It is important to understand that this is not the same as amending a tax return. This does not open the taxpayer up to a reset of an audit for previous years’ tax returns since they are not being amended.

What if the Farmer or Rancher Can’t Pay?

Farmers and ranchers who are faced with difficulty in paying the income and self-employment taxes triggered by the IRA program payments need to consider options in making payments.

- Farmers and ranchers facing this circumstance may qualify for a payment plan or installment agreement with the IRS.

- Visit https://www.irs.gov/taxtopics/tc202 to learn more about payment plans.

- Farmers and ranchers are strongly encouraged not to avoid filing their respective tax returns because they cannot pay. The penalties and interest will increase.

Are There Other Options?

Farmers and ranchers who received IRA payments may retroactively decline these payments. Those wishing to do so should consult with a tax professional to ensure they understand the impact of this option.

To decline, farmers and ranchers may contact their local FSA office or the FSA Call Center at 1-877-508-8364 before December 31, 2023.

Summary

The farmer or rancher does not have to sign up for the IRA debt relief program of 2022, the USDA FSA has already identified eligible program payment recipients. However, subsequent IRA assistance for distressed borrowers may require an application in 2023. Most borrowers that receive a payment will not receive any of the cash directly, as it will be applied to the loan that is presently in delinquency. The program payment is considered a taxable event. There are different options available to FSA direct loan borrowers and the guaranteed loan borrower. The program payment recipient received a letter from USDA FSA letting the borrower know of the program payment and that it has been directly applied to the loan or is to be applied to the loan. The borrower received a 1099-G from the USDA FSA in early 2023 for tax year 2022. Corrected 1099-Gs and a new 1099-C were issued with a new cover letter in April 2023. Once the borrower receives the new letter, they should immediately check their loan account to determine and confirm the amount of principal and interest that has been paid. There are options available to both direct loan borrowers and guaranteed loan borrowers to manage the resulting tax liability. The IRA program payment recipient should also work with their tax professional to let them know of the program payment to evaluate options available to minimize the resulting tax liability.

Additional Topics

This fact sheet was written as part of Rural Tax Education, a national effort including Cooperative Extension programs at participating land-grant universities to provide income tax education materials to farmers, ranchers, and other agricultural producers. For a list of universities involved, other fact sheets and additional information related to agricultural income tax please see RuralTax.org.

- 1099s: https://ruraltax.org/files-ou/1099s.pdf

- Self-Employment Tax: http://ruraltax.org/files-ou/2022_SE_Tax.pdf

- Optional Method of Paying Self-Employment Tax: https://ruraltax.org/files-ou/FarmOptionalSETax.pdf

- How to Choose a Tax Professional: https://ruraltax.org/files-ou/ChooseTaxProfessional.pdf

- Tax Estimator Tool: http://www.ruraltax.org/tax-estimator

Other Links

- Inflation Reduction Act Assistance for Distressed Borrowers: https://www.farmers.gov/inflation-reduction-investments/assistance

- USDA Tax Information Page: https://www.farmers.gov/working-with-us/taxes

This information is intended for educational purposes only. You are encouraged to seek the advice of your tax or legal advisor, or other authoritative sources, regarding the application of these general tax principles to your individual circumstances. Pursuant to Treasury Department (IRS) Circular 230 Regulations, any federal tax advice contained here is not intended or written to be used, and may not be used, for the purpose of avoiding tax-related penalties or promoting, marketing or recommending to another party any tax-related matters addressed herein.

USDA is an equal opportunity provider, employer, and lender. Rural Tax Education is part of the National Farm Income Tax Extension Committee. The land-grant universities involved in Rural Tax Education are affirmative action/equal opportunity institutions.

This material is based upon work supported by the U.S. Department of Agriculture, under agreement number FSA21CPT0012032. Any opinions, findings, conclusions, or recommendations expressed in this publication are those of the author(s) and do not necessarily reflect the views of the U.S. Department of Agriculture. In addition, any reference to specific brands or types of products or services does not constitute or imply an endorsement by the U.S. Department of Agriculture for those products or services.

Published May 2023