Taxability of USDA Discrimination Financial Assistance Program Awards Resulting from the Inflation Reduction Act of 2022

Guido van der Hoeven, Emeritus, North Carolina State University

CAUTION: Recipients of DFAP awards are strongly encouraged to seek tax advice from competent advisors. Taxability is dependent on facts and circumstances of the individual cases, especially regarding the DFAP award being subject to self-employment tax. For more information about how to find a competent tax advisor, please go here: [https://www.farmers.gov/your-business/taxes#training]

Introduction

The Inflation Reduction Act (IRA), [P.L. 117-169], included a provision under section 22007 of the Act authorizing USDA to address issues of past discrimination in the Department’s farm lending programs. Under the resulting program, the Discrimination Financial Assistance Program (DFAP), farmers, ranchers, and forest landowners who experienced discrimination in USDA farm lending before 2021 could apply for financial assistance from the Department. This fact sheet addresses the income tax issues associated with the receipt of DFAP financial assistance.

Award of Financial Assistance Through USDA's Discrimination Financial Assistance Program (DFAP)

A DFAP award is taxable income. Depending on the individual’s facts and circumstances the award may also be subject to self-employment tax. Therefore, recipients should consult with a tax professional and plan to set aside a portion of the award to pay the forthcoming tax bill.

This document provides guidance to recipients and their tax professionals regarding the receipt of a DFAP award and examples of reporting DFAP awards depending on facts and circumstances of the recipient.

Program Background

Section 22007 of IRA authorized USDA to create a mechanism to address past discrimination and provide an application process for farmers and ranchers who might have experienced discrimination in USDA farm lending programs prior to January 1, 2021.

Discrimination for this program is defined in USDA’s FAQs as:

Discrimination means treating some people differently from others, for illegitimate reasons. In this program, a claim of discrimination may be based on different treatment you experienced because of race, color, national origin or ethnicity, sex, sexual orientation, gender identity, religion, age, marital status, or disability, or in reprisal/retaliation for prior civil rights activity. Covered discrimination could include, for example: failure to provide appropriate assistance; delay in processing a loan or loan servicing application; denial of a loan or loan servicing; prevention from applying for a loan or loan servicing; adverse loan terms; unduly onerous supervision of loan requirements—where these were due to the customer’s race, color, national origin or ethnicity, sex, sexual orientation, gender identity, religion, age, marital status, or disability, or in reprisal/retaliation for prior civil rights activity.

The original deadline for DFAP applications was October 31, 2023; subsequently, the deadline for receipt of applications was extended to January 17, 2024, and is now closed.

In making the DFAP application, applicants provided responses to several questions in order for the financial assistance award to be evaluated and any award to be issued correctly. Applicants responded to the questions in a manner which best described their circumstances, depending on whether:

- The DFAP applicant was the farm loan borrower or an intended borrower.

- The DFAP applicant had a co-borrower (e.g., spouse).

- The DFAP applicant participated in an entity that farmed (e.g., partnership).

Some DFAP participants have or had farming or ranching operations on land owned, leased or a combination of the two, and others intended to have such operations but were unable to do so due to discrimination at the start of the intended farming business.

USDA contracted with third parties to provide free assistance to individuals who believed they qualified. The free assistance included help with filing and/or submitting the application and supporting documentation. Applications could be e-filed, or mailed or delivered in person to DFAP offices (which were run by contracted program administrators).

The review process of applications received uses two independent teams to help USDA make determinations relative to successful applicants. A flow chart of the process can be found at https://22007apply.gov/media/22007-flowchart-english.pdf . Applications are now in the review process with successful applicants targeted to receive awards in summer 2024.

Once the applications are approved and awards issued, next the recipient will receive an IRS Form 1099. As in the Pigford discrimination case of 2008 (also known as the Black Farmers Discrimination Case), USDA will issue an IRS Form 1099-MISC; to be issued January 2025.

Tax Issues Resulting from Receipt of a DFAP Award

In February of 2024, the IRS issued a fact sheet (FS-2024-05) with FAQs regarding USDA’s DFAP. The FAQ guidance provided by the IRS is below in the entirety of the FAQs as published.

Q1. I received a payment of financial assistance through the Program. Is the payment includible in my gross income for federal income tax purposes? (added Feb. 23, 2024)

A1. Yes. The payment is includible in gross income under section 61 of the Internal Revenue Code.

Q2. I hired an attorney to assist me in applying for financial assistance through the Program. May I deduct the fees paid to my attorney? (added Feb. 23, 2024)

A2. Yes. Fees paid to an attorney in connection with any action involving a claim of unlawful discrimination may be deducted “above-the-line,” but the deduction is limited to the amount of any payment you received from the Program. You can claim this deduction as an adjustment to income on Schedule 1 (Form 1040), line 24h.

Q3. I received a payment of financial assistance through the Program. Is the payment subject to self-employment tax? (added Feb. 23, 2024)

A3. It depends on your particular facts and circumstances. Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves so they may receive Social Security and Medicare benefits later. It is similar to Social Security and Medicare taxes withheld from the pay of most wage earners. Self-employment tax is imposed on your net earnings from self-employment, which generally means the gross income derived from carrying on a trade or business, less certain deductions attributable to the trade or business.

For self-employment tax purposes, generally there must be a connection (nexus) between the gross income (here, that is the financial assistance payment you received) and a trade or business that is, or was, carried on. A trade or business is generally an activity carried on for a livelihood or in good faith to make a profit. The facts and circumstances of each case determine whether an activity is a trade or business. You do not need to make a profit to be in a trade or business as long as you have a profit motive, but you do need to make ongoing efforts to further the interests of your business. Generally, the required nexus exists if it is clear you received the financial assistance payment because of your individual conduct of a trade or business, including if you received the payment as compensation for lost income of a trade or business. You are usually self-employed if you operate your own farm on land you either own or rent.

CAUTION: Recipients of DFAP awards are strongly encouraged to seek tax advice from competent advisors. Taxability is dependent on facts and circumstances of the individual cases, especially regarding the DFAP award being subject to self-employment tax.

Examples of DFAP Awards and Income Tax Reporting

In the following examples, recipients of DFAP awards may see an example(s) which generally align with their circumstances. These examples are for illustrative purposes only and do not constitute official advice about any particular set of circumstances.

Example 1: Receiving a DFAP Award and Still in the Business of Farming

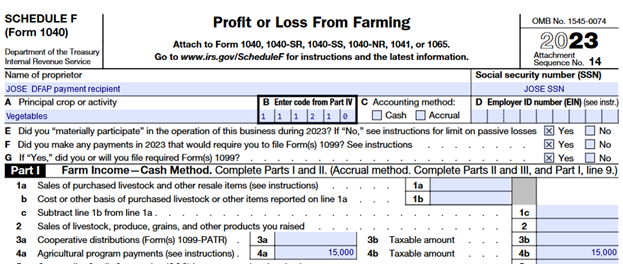

Jose operates a truck farm growing vegetables and selling them in both wholesale and retail markets. In 2010 Jose applied for a $50,000 loan through USDA’s Farm Service Agency (FSA) to update his packhouse. Jose was denied the loan due to discrimination. Jose found other means to finance the upfit, though on more expensive terms. Jose submitted an application for a discrimination award through the DFAP. His application was approved, and he received a discrimination award of $15,000 (for illustrative purposes only). Jose receives a Form 1099-MISC with $15,000 being reported. Since Jose is still in business (has nexus), he reports this award on Line 4, Schedule F; thus, it is subject to ordinary income tax and self-employment tax. See Jose’s Schedule F illustrated below, 2023 Schedule F (2024 Schedule F was not available).

Jose’s marginal tax rate is estimated to be 32.3 percent (12 percent federal income tax, 15.3 percent self-employment tax and 5 percent state income tax) resulting in $4,845 of tax liability ($15,000 x 0.323).

Example 2: Receiving a DFAP Award After Retirement from Farming

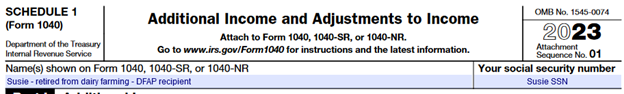

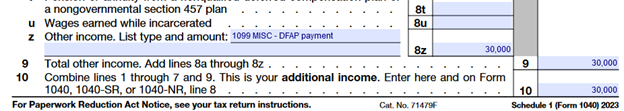

Susie operated a dairy farm which sold milk and artisan cheeses. In 2015 Susie applied to FSA for an operating loan and a loan for capital improvement to her milking parlor. Susie’s loan requests totaling $100,000 were denied; an FSA employee said to her that “women can’t run a profitable dairy”. Susie continued to struggle and in 2018 Susie liquidated her dairy herd and sold the equipment and retired from farming completely. In the fall of 2023 Susie made an application for a discrimination award through DFAP. Her application was approved, and she received an award of $60,000 (for illustrative purposes only). She received a Form 1099-MISC in the amount of $60,000. Because Susie retired from farming an argument could be made that there is no nexus to a farming business (though whether or not this is the case in other examples depends on the specific circumstances). Susie’s DFAP award is taxable income but not subject to self-employment tax, thus, Susie reports this income on Schedule 1, Line 8z.

Susie’s marginal tax rate is estimated to be 17 percent (12 percent federal income tax and 5 percent state income tax) resulting in $10,200 of tax liability ($60,000 x 0.17).

Example 3: Receiving a DFAP Award as an Intended Producer

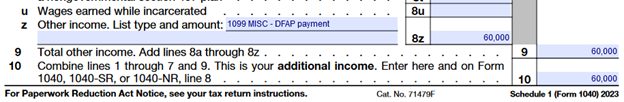

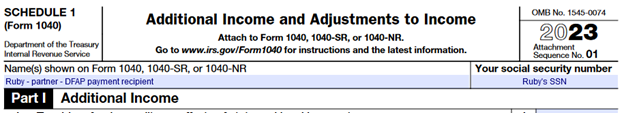

Running Fox applied for a beginning farmer/rancher loan when he was 19 years old after graduating from a technical school. He requested $150,000 for his loan to purchase equipment and to cover operating expenses. Running Fox was denied the loan in 1996. Running Fox chose to pursue other opportunities to earn a living. Hearing about DFAP, Running Fox applied for a discrimination award; his application was approved. Running Fox received an award of $30,000 (for illustrative purposes only). Because he was unable to begin a farming operation, there was no nexus to a trade or business (though whether this would be the case in other examples depends on the specific circumstances). Thus, Running Fox reports this income on Line 8z of Schedule 1, Form 1040, (the 2024 Schedule 1 form was not available).

This award to Running Fox is subject to ordinary income tax but not self-employment tax because he never started a farming business. If Running Fox has a marginal income tax rate of 27 percent; 22 percent federal and 5 percent state; his tax liability is $8,100 ($30,000 x 0.27).

CAUTION: If Running Fox, in the example above, receives a Form MISC in the amount of $30,000, the IRS matching program may “look” for this income to be reported on Schedule F, Line 4. However, because Running Fox never farmed, this income should not be subject to self-employment tax. Reporting the award on Line 8z of Schedule 1 is the proper line to use, however, a CP-2000 letter might be issued by the IRS to match this income. Thus, a follow-up letter to explain where Running Fox did indeed report the DFAP award may be necessary.

Example 4: Receiving a DFAP Award as a Partner or Member of an LLC

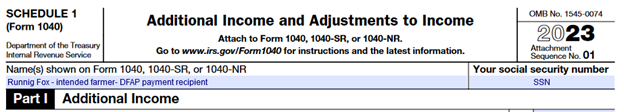

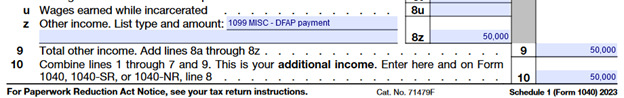

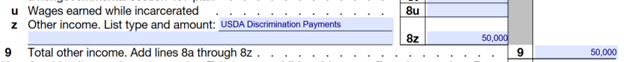

Ruby is a member of a farming partnership, 4-S Farms, with her three sisters each having equal ownership. In 2003, 4-S Farms applied for a $400,000 loan through FSA for a land purchase. The loan was denied due to discrimination against the women. Because discrimination occurred at the partnership level, not at the individual level, and each of the partners made an application under DFAP; each received $50,000 issued individually. If Ruby and her three sisters continued the partnership and each received an award, generally, nexus will exist to the 4-S Farms. Thus, each partner will individually file a Schedule F as illustrated in Example 1. However, an argument might be made there is no nexus to the DFAP awards if Ruby or one of the other partners of 4-S Farms retired from the partnership. Therefore, if this is the case, Ruby would report her award on Line 8z of Schedule 1 making the award subject to ordinary income tax. Ruby’s partial Schedule 1 is below (2024 Schedule1 was not available).

If Ruby’s marginal tax rate is 27 percent (22 percent Federal and 5 percent state) her tax liability on this financial assistance award is $13,500 ($50,000 x 0.27).

CAUTION: Recipients of DFAP awards who are partners (partnership) or members (LLC) are strongly encouraged to seek tax advice from competent advisors. Taxability is dependent on facts and circumstances of the individual cases, especially regarding the question of nexus to the entity which was subject to discrimination and thus may be subject to self-employment tax.

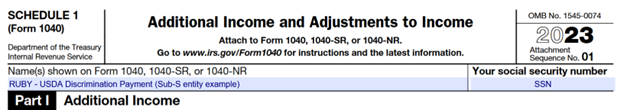

Example 5: Receiving a DFAP Award as a Shareholder/Employee of a Sub-S Corporation

The facts are the same as in Example 4, except that instead of a partnership, the entity is a Sub-S Corporation. An argument could be made that the DFAP award has the same characteristic of a dividend distribution (not rents nor wages) from the corporation. Ruby, in this fact pattern, would report the $50,000 award on Line 8z of Schedule 1, Form 1040 making the award subject to ordinary income tax but not self-employment tax (the 2024 Schedule 1 form was not available).

Thus, this award would not be subject to self-employment tax in this circumstance, Ruby’s marginal tax rate is 27 percent resulting in a tax liability of $13,500 ($50,000 x 0.27).

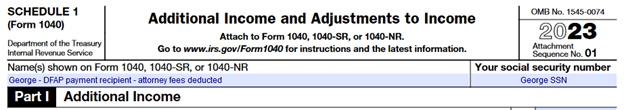

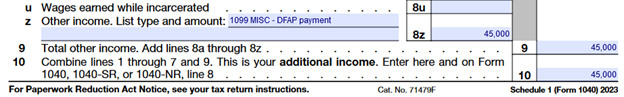

Example 6: Deducting Attorney Fees in Regard to a DFAP Award

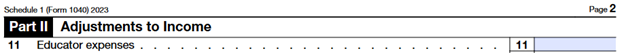

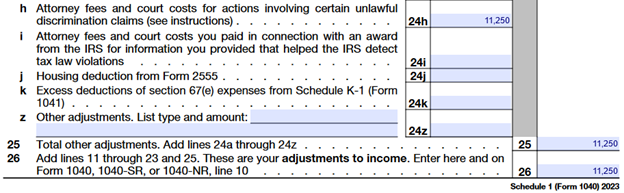

Many years ago, George operated a crop farm in Georgia. George applied for a loan to expand his operation, USDA discriminated against him and denied the $300,000 loan request. George became disabled and retired from farming many years ago. George learned of USDA’s financial assistance program and engaged an attorney to help him. The engaged attorney charged a 25 percent contingency fee. George’s application was accepted, and he received an award of $45,000. The attorney’s fees were $11,250. Because George is retired, the $45,000 award is reported on Line 8z of Schedule 1, Form 1040 as in the previous example. However, George may deduct his attorney fees on Line 24h, Schedule 1, Form 1040 as illustrated below. (2024 forms unavailable at this time)

Deducting Attorney Fees for DFAP Applications on Part II of Schedule 1, Line 24h

CAUTION: Recipients of DFAP awards are strongly encouraged to seek tax advice from competent advisors. Taxability is dependent on facts and circumstances of the individual cases, especially regarding the DFAP award being subject to self-employment tax.

Summary

The USDA DFAP awards authorized through IRA section 22007 are subject to income tax. Depending on the facts and circumstances of the individual, these awards may also be subject to self-employment tax. These awards are expected to be issued in the summer of 2024. Recipients of these awards are strongly advised to seek tax advice from a competent tax professional to help determine and manage the resulting tax consequences and how much money to set aside for the award of taxes owed.

Tax Authority, References and Resources

- IRS Publication 225, The Farmer’s Tax Guide (https://www.irs.gov/pub/irs-pdf/p225.pdf)

- Rul. 91-19, 1991-1 CB 186, IRC Sec(s). 1402

- Reg. Treas Reg. 1.1402(a)-1(c)

- IRS Tax Computation/Accounting Period Changes (https://www.irs.gov/irm/part21/irm_21-006-004r)

- Pigford v. Glickman, Pigford II (Black Farmers Discrimination Litigation)

- Jackson v. Commissioner 108 TC 130, Code Sec(s) 1401; 1402.

- Milligan v Commissioner TCM 1992-655

- Newberry v Commissioner 76TC 441, 444

Tax Educational Resources

Tax Training Videos from Farmers.gov: https://www.farmers.gov/your-business/taxes#training

Finding a Tax Professional

Webinar: https://www.youtube.com/watch?v=j6t7Dti3WRs

Fact Sheet: https://extension.usu.edu/ruraltax/tax-topics/how-to-choose-a-tax-professional

This fact sheet was written as part of Rural Tax Education, a national effort including Cooperative Extension programs at participating land-grant universities to provide income tax education materials to farmers, ranchers, and other agricultural producers. For a list of universities involved, other fact sheets, and additional information related to agricultural income tax, please see RuralTax.org.

This information is intended for educational purposes only. You are encouraged to seek the advice of your tax or legal advisor, or other authoritative sources, regarding the application of these general tax principles to your individual circumstances. Pursuant to Treasury Department (IRS) Circular 230 Regulations, any federal tax advice contained here is not intended or written to be used, and may not be used, for the purpose of avoiding tax-related penalties or promoting, marketing or recommending to another party any tax-related matters addressed herein.

USDA is an equal opportunity provider, employer, and lender. Rural Tax Education is part of the National Farm Income Tax Extension Committee. The land-grant universities involved in Rural Tax Education are affirmative action/equal opportunity institutions.

This material is based upon work supported by the U.S. Department of Agriculture, under agreement number FSA21CPT0012032. Any opinions, findings, conclusions, or recommendations expressed in this publication are those of the author(s) and do not necessarily reflect the views of the U.S. Department of Agriculture. In addition, any reference to specific brands or types of products or services does not constitute or imply an endorsement by the U.S. Department of Agriculture for those products or services.

Published July 2024