Tangible Property Regulations: De Minimis Safe Harbor

Guido van der Hoeven, Extension Specialist / Senior Lecturer Emeritus

Department of Agricultural and Resource Economics, North Carolina State University

Introduction

The Internal Revenue Service (IRS) released final regulations that deal with tangible property on September 17, 2013, which provide guidance concerning their tax treatment [Treasury Decision 9636, 2013-43 I.R.B. 331]. These regulations became effective as of January 1, 2014, and provide guidance on tax issues that have perplexed many farmers and ranchers. The question of whether to currently deduct the cost of a repair or capitalize the cost and recover it using the applicable depreciation rules are clarified by the final regulations.

Additionally, these regulations provide safe harbors which may be used by businesses such as farms and ranches. The de minimis safe harbor is the focus of this fact sheet. The de minimis safe harbor provides a tax planning opportunity which can be used by farmers and ranchers to simplify their accounting and annual records.

De Minimis Safe Harbor Overview

Use of the de minimis safe harbor allows farmers and ranchers to currently deduct some small expenditures for the production or acquisition of new property. The safe harbor also includes or allows for improvements made to existing property to be deducted. Under the original final regulations, the safe harbor amounts were $500 for farmers/ranchers who do not have applicable financial statements (AFS), discussed later; for those who do have an AFS the amount was $5,000. Following public input, the IRS released Notice 2015-82, which increased the amount of the safe harbor limit to $2,500, effective on January 1, 2016, for those farmers/ranchers who do not have an AFS, while the larger amount remained at $5,000.

The de minimis safe harbor allows farmers and ranchers to currently deduct the cost of acquisitions or produced units of production of tangible property for their businesses. These purchased or produced items must have 12 or less months of economic life in the normal course of operations. These costs are subject to the maximum $2,500 or $5,000 limit. Therefore, the safe harbor makes allowance for the farmer/rancher to deduct expenditures which normally would have been required to capitalize under the Uniform Capitalization Rules as found in Internal Revenue Code (IRC) section 263(a).

Example 1:

Annie operates a peach orchard. This year she purchased four chainsaws at a cost of $400 each, which have a useful life of 4 years. Before the availability of the de minimis safe harbor, Annie would have been required to capitalize and depreciate the cha

The regulations require that a purchase invoice is needed to provide documentation of the purchased item which is deducted under the safe harbor. Furthermore, the farmer or rancher may want to consider requesting separate invoices if additional charges are included such as delivery or installation costs. Thus, an invoice for the tangible property is separate from the ancillary services or costs.

Example 2:

Annie, from Example 1, paid shipping costs of $100 for the chainsaws. Shipping is an ordinary and necessary expense for doing business and, as such, is deductible on Annie’s Schedule F, Line 18, Freight and Trucking; a separate invoice for shipping facilitates this current deduction.

Farmers and ranchers may not selectively pick and choose items to currently deduct (expense) under the de minimis safe harbor. This means that a farmer/rancher electing to use this safe harbor must deduct all expenditures for all units of acquired property which meet the safe harbor requirements. For cash-basis farmers/ranchers, the cost paid during the tax year are so deducted; for accrual-basis farmers/ranchers those expenses which are incurred during the tax year.

For temporary or standby emergency parts, which the farmer or rancher elects to capitalize and then depreciate under Treas. Reg. § 1.162-3(d), the de minimis safe harbor does not apply. This applies to rotable parts, too. Rotable parts are those which can be used several times after being repaired. A spare irrigation engine is an example of a rotable part.

Repairs and Maintenance

Not to be confused with the de minimis safe harbor rules, repair and maintenance expenses are still deductible as an ordinary and necessary business expenditures. This is true even if the cost of the repair is greater than elected de minimis amount.

Example 3:

Ahmad operates a nut and fruit ranch in California. This year he replaced the final drive on the left side of one of his 5-year-old orchard tractors. The cost of this repair was $9,500. The repair brought the tractor back into operation. The repair did not i) change the use, ii) restore; nor did it iii) improve (or make better) the tractor. The $9,500 is allowed as a current deduction on Ahmad’s Schedule F, Line 25, Repairs.

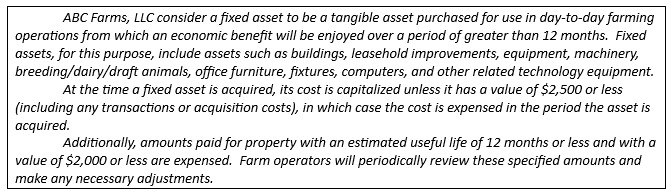

Accounting for the De Minimis Safe Harbor

Farmers and ranchers are required to have an accounting procedure in place prior to the tax year in which they plan to take advantage of the de minimis safe harbor. This procedure outlines that treatment of certain costs of tangible property at or below a specified amount or which has an economic useful life of 12 months or less. Generally, most farmers/ranchers will not have an AFS (defined later) and thus will use up to $2,500 for their de minimis value; the accounting policy does not need to be in writing, however, it is strongly advised, as a best management practice, to have a written policy.

Qualifying Requirements of the De Minimis Safe Harbor

There are two requirements which need to be met to qualify for use of this safe harbor.

- The expenditure must be currently deductible under the farmer’s accounting procedure which was in place at the beginning of the farm’s tax year. Which means that one or both limits are met.

- An elected expense limit is determined (note: this limit can be greater than $2,500 or $5,000 for this safe harbor)

- A 12-month limit on the useful life of the property purchased (which may also have a dollar limit)

- The amount paid by the farmer/rancher cannot exceed the $2,500 or $5,000 safe harbor limit, respectively, which is determined by having or not having an AFS.

Expensing Limit Policy

For general business accounting purposes, the farmer or rancher may have a non-tax accounting procedure which sets a per-item expensing limit either higher or lower than that which is allowed for tax purposes. Thus, if set higher under this accounting procedure, the tax regulations limit the deduction to $2,500 without an AFS or $5,000 with an AFS. This expensing policy can accommodate two outcomes; first, it can set different dollar limits for different types of tangible assets; second, it can provide an exclusion for certain specified types of property.

Example 4:

Ruth operates a dairy farm; she buys her replacement heifers. Historically, Ruth’s average cost of a replacement heifer is $1,250. Ruth also has an accounting procedure to facilitate her use of the de minimis safe harbor; she does not have an AFS and selects $2,500 as her limit. Because she wants to take advantage of possible capital gains treatment on the sale of any purchased replacement heifers, Ruth establishes a “carve out” and does not apply the de minimis expensing of her purchased heifers. Therefore, should she sell one of her purchased replacement heifers for $2,200, she recaptures the required depreciation on the $1,250 cost, but she benefits by treating the $950 gain above her initial purchase price as capital gains under the IRC § 1231 rules. This can be a significant tax savings over time.

Economic-Useful-Life Policy

Application of the de minimis safe harbor is somewhat constrained by the useful economic life of 12 months or less. The constraint is that even if the farmer’s or rancher’s accounting policy is such that it treats the cost as a current deduction regardless of size; the safe harbor only allows a cost of $2,500/$5,000 or less as a tax deduction depending on AFS requirements. Considerations in determining economic useful life include the following:

- Wear and tear, decay or decline from natural causes, e.g., rust.

- Economic changes, inventions, and current developments in agriculture and the business model the farmer employs, e.g., obsolescence.

- Climatic and local conditions which may affect the farm or ranch.

- The farmer’s or rancher’s accounting policy on repairs, renewals, and replacements.

If a farmer/rancher created a formal de minimis policy to handle asset purchases that will be deducted vs. capitalized under the $2,500/$5,000 value regardless, the asset will not need to have a useful life expectancy of 12 months or less.

Applicable Financial Statement Considerations of the Safe Harbor

The de minimis safe harbor, as found in the final regulations, defines an applicable financial statement as one of the three items listed below. These are listed in descending order of priority.

- A financial statement that the farmer/rancher must file with the Securities and Exchange Commission (SEC). (This is not likely)

- A certified, audited financial statement that is accompanied by the report of an independent CPA and that is used for credit purposes; reporting to shareholders, partners, or similar persons; or any other substantial non-tax purpose. (This is possible as modern farms and ranches become more sophisticated in organizational structures.)

- A financial statement (other than a tax return) that the taxpayer must provide to a federal or state government or an agency other than the SEC or IRS. (This may be more plausible for some farms and ranches)

If a farm meets one of the above criteria, then the de minimis amount increases to $5,000.

Figure 1. Example of a Farm or Ranch (no AFS) Written Accounting Policy

Use of the de minimis safe harbor requires an annual election to be made by the farmer or rancher for the applicable tax year. To make the election, the farmer or rancher must be an eligible taxpayer (one who has an accounting procedure in place, discussed above). The annual election is made with reference to and according to the accounting procedure in place, e.g., a specified de minimis amount or identifying statement relative to items with an economic useful life of 12 months or less. This election statement must be attached to the farmer’s or rancher’s timely filed original income tax return (including extensions). Upon making the election, the farmer or rancher cannot revoke the election for that tax year. However, an amended superseding tax return can be filed prior to the deadline for the tax return (generally by April 15), which does not make the election to use the de minimis safe harbor.

For Subchapter S corporations, LLCs (taxed as either a partnership or corporation), and partnerships, it is the entity that makes the election to use the de minimis safe harbor, not the shareholders, members, or partners.

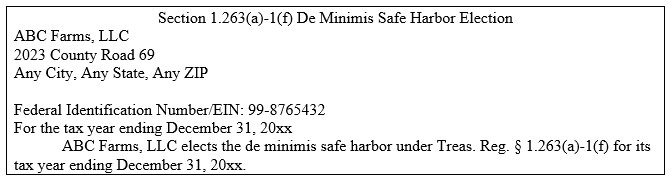

The final regulations require that the annual elections statement be made in a specified manner. The election statement must include:

- Title: “Section 1.263(a)-1(f) De Minimis Safe Harbor Election”.

- Farmer/Rancher name, address, taxpayer identification number.

- The tax year of the election.

- Affirming statement that the de minimis safe harbor election is made under the allowable Treasury Regulation.

Figure 2. Example of De Minimis Safe Harbor Election Statement

Summary

Use of the de minimis safe harbor can simplify the accounting records and provide income tax benefits to farmers and ranchers regardless of scale of operations. Competent professional tax advice is strongly suggested to be sought relative to the facts and circumstances of an individual farm or ranch to learn if making such an election to use this safe harbor is of value.

IRS Publications

To access the forms discussed in this paper and other IRS forms and publications, go to www.irs.gov and click on “Forms and Publications”. Then click on “Publication number” under “Download forms and publications by:” Type the publication number in the find box to search for the publication. Publications may be viewed online or downloaded by double clicking on the publication.

IRS Final Regulations, Treasury Decision 9636. https://www.irs.gov/irb/2013-43_IRB

IRS Notice 15-82. This publication explains the increase of de minimis value without an applicable financial statement. https://www.irs.gov/pub/irs-drop/n-15-82.pdf

IRS FAQs for tangible property regulations. https://www.irs.gov/businesses/small-businesses-self-employed/tangible-property-final-regulations

National Income Tax Workbook, 2016, Pages 268-272, Issue 1: Tangible Property Regulations Update.

Additional Topics

This fact sheet was written as part of Rural Tax Education, a national effort including Cooperative Extension programs at participating land-grant universities to provide income tax education materials to farmers, ranchers, and other agricultural producers. For a list of universities involved, other fact sheets, and additional information related to agricultural income tax, please see RuralTax.org.

This information is intended for educational purposes only. You are encouraged to seek the advice of your tax or legal advisor, or other authoritative sources, regarding the application of these general tax principles to your individual circumstances. Pursuant to Treasury Department (IRS) Circular 230 Regulations, any federal tax advice contained here is not intended or written to be used, and may not be used, for the purpose of avoiding tax-related penalties or promoting, marketing or recommending to another party any tax-related matters addressed herein.

USDA is an equal opportunity provider, employer, and lender. Rural Tax Education is part of the National Farm Income Tax Extension Committee. The land-grant universities involved in Rural Tax Education are affirmative action/equal opportunity institutions.

This material is based upon work supported by the U.S. Department of Agriculture, under agreement number FSA21CPT0012032. Any opinions, findings, conclusions, or recommendations expressed in this publication are those of the author(s) and do not necessarily reflect the views of the U.S. Department of Agriculture. In addition, any reference to specific brands or types of products or services does not constitute or imply an endorsement by the U.S. Department of Agriculture for those products or services.

Published April 2023