Depreciation: An Introduction

Mark Dikeman, Executive Director, Kansas Farm Management Association, Department of Agricultural Economics, Kansas State University

Introduction

An agricultural business may purchase a variety of items that will be used or consumed in the process of growing or raising agricultural products. Some items, like seed or feed, are used or consumed within 12 months of purchase and the cost is deducted in full as a current expense. Other items such as equipment, buildings, and dairy or breeding livestock have a useful life that is greater than one year. Generally, the cost of property with a useful life of greater than one year is recovered over a number of years through an annual income tax deduction for depreciation.

The rules and regulations related to depreciation can be quite complicated. In most cases, to calculate a deduction for depreciation for a particular asset, a taxpayer will need to:

- Determine the date the property was placed in service

- Calculate the basis of the property

- Determine which depreciation convention applies

- Identify the recovery period of the property

- Make an election regarding depreciation method

- Make an election regarding Special Depreciation Allowance (Bonus depreciation)

- Make an election regarding §179 expensing deduction

This article will introduce depreciation and depreciation calculations. Additional articles are available at ruraltax.org that provide more in-depth information regarding the items listed above.

Property That is Depreciated

Property is depreciable if it is property that you own, property that is used in a business or income producing activity, property that has a determinable useful life, and property that is expected to last longer than one year.

In agriculture production, property such as vehicles, machinery, equipment, buildings, fences, and draft, dairy or breeding livestock are all depreciable property. Land does not have a determinable useful life, so it is not depreciable.

Placed in Service Date

Depreciation calculations depend on the date that property was placed in service. An item is placed in service when it is ready and available for a specific use. It is not required that the item actually be used by that date, only that it is ready and available.

Example 1: Amaija is a calendar year, cash basis taxpayer. She purchased a planter from her local implement dealer on December 12, and the planter was delivered to her farm on December 14. Amaija first used the planter on April 1 of the following year. The in-service date for the planter is December 14 because it was ready and available for use at the time it was delivered to the farm.

Property Basis

Purchased personal property generally has a basis that is equal to the cost of the property, but basis will also include expenses to deliver, assemble, or install the item, as well as any sales tax paid at the time of purchase. When determining cost, it does not matter if an item was paid for with cash or if it was financed.

Example 2: Jace purchased a pull-type sprayer for use in his farming business. The sprayer was purchased for $20,000 plus $1,500 sales tax. He also had to pay a trucking company $1,000 to deliver the sprayer to his farm. Jace paid his local implement dealer $750 to calibrate the sprayer. For depreciation purposes, his basis in the sprayer is $23,250 ($20,000+1,500+1,000+750).

The basis of property can become complicated when a combination of cash or financing and another item (trade-in) are used to fund the purchase. Prior to 2018, a purchase that involved a trade-in was generally treated as a like-kind exchange. However, income tax law changes eliminated the possibility of a like-kind exchange for personal property (non-real property). As a result, for depreciable farm property purchased after 2017, the basis of the new property is equal to the portion purchased with cash or financing (trade difference or boot paid) plus the amount allowed for the asset given up in the trade. The old item is treated as being sold for the amount of the trade allowance.

Example 3: Justin purchased a new tractor. As part of the purchase, he paid $50,000 in cash and traded the dealer his old tractor. The dealer allowed him $75,000 for his old tractor. Justin’s basis for depreciation is $125,000 ($50,000 trade difference plus $75,000 trade allowance). In addition, Justin will also treat the old tractor as if it were sold for $75,000.

Depreciation Convention

The depreciation convention determines the number of months that depreciation is claimed in the year the property is placed in service. Generally, the half-year or mid-quarter convention will apply to agricultural machinery, equipment, or livestock used for draft, breeding, or dairy purposes. The mid-month convention will apply to residential rental property and nonresidential real property.

If property is such that the mid-month convention does not apply, a calculation is needed to determine if the mid-quarter or half-year convention applies. The outcome of the convention calculation applies to all property placed in service during the year. In other words, the same convention applies to all property (that is not mid-month) in a tax year.

The mid-quarter convention applies when more than 40% of the total depreciable bases of applicable property are placed in service in the last quarter of the year. The basis of certain property, such as nonresidential real property, residential rental property, and property placed in service and disposed of in the same year, is excluded from this calculation. Also excluded are amounts deducted using the §179 deduction. Because of this, electing §179 can potentially shift the required depreciation convention away from mid-quarter to half-year.

When the mid-quarter convention applies, depreciation calculations begin at the mid-point of the quarter in which the property was placed in service. For property placed in service in the first quarter, depreciation is calculated for 1 ½ months of the first quarter plus three months each for the following three calendar quarters. This can be simplified by taking 7/8 of the year for each property placed in service in the first quarter, 5/8 each for the second quarter, 3/8 each for the third quarter, and 1/8 of the year for each property placed in service in the fourth quarter.

When neither the mid-month nor mid-quarter convention applies, the half-year convention is used. As the name implies, first year depreciation begins at the halfway point in the year, regardless of when the property was placed in service.

Example 4: Pearce purchased a corn header and a grain cart during the tax year. The corn header was placed in service on October 20, and has a basis for depreciation of $60,000. The grain cart was placed in service on July 10, and has a basis for depreciation of $65,000. Because 48% (60,000/[60,000+65,000]) of total basis was placed in service in the fourth quarter, Pearce is required to use the mid-quarter convention for both the grain cart and the corn header. He would be allowed 1/8 of a year of depreciation for the corn header and 3/8 of a year of depreciation for the grain cart.

Recovery Period

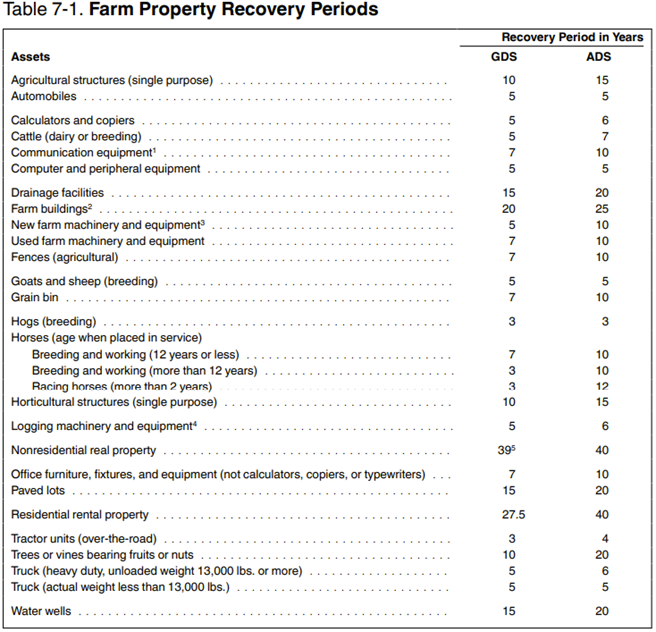

The period of time used for depreciation deductions for personal property is its recovery period. The recovery period depends on the depreciation system that is used and the class of the property. Table 7-1, Farm Property Recovery Periods, in IRS Publication 225 – Farmers Tax Guide can be referenced to determine the appropriate recover period for depreciable agricultural property. Table 7-1 is reproduced below.

Two options are available for depreciation systems, General Depreciation System (GDS) and Alternative Depreciation System (ADS). In most cases, GDS will be used. However, in certain cases, you can elect to use ADS to lengthen the recovery period, which will decrease the amount of depreciation taken in the year the property is placed in service. Slowing depreciation may be useful when taxable income is low or negative.

Certain agricultural property must be depreciated using ADS, such as listed property that is used 50% or less in a farming business. There may be other, less common, scenarios where ADS is required.

Once a depreciation system is determined, the recovery period can be identified based on the type of property. If a piece of farm machinery or equipment is not listed in Table 7-1, it will generally fall into either the “New farm machinery and equipment” or “Used farm machinery and equipment” categories.

Note that although a recovery period specifies a number of years, depreciation deductions for that property will take place over one additional income tax year compared to the recovery period. As discussed under depreciation convention earlier, depreciation is only allowed for a portion of the year that property is placed in service. This means that the final year of depreciation is also a partial year.

Example 5: Courtney purchased a used hay baler. Under the GDS depreciation system, she would depreciate the baler for 7 years. If the half-year convention applies, she will claim a depreciation deduction for half of the year in the year the baler is placed in service, followed by a full year of depreciation in years 2 through 7. The final half-year of depreciation would be claimed in year 8.

Depreciation Method

The depreciation method determines the timing of the income tax deductions for depreciation. Note that total depreciation does not change between different depreciation methods, only the timing of deductions. For property used in agricultural production, there are several depreciation methods available.

For farm property with a recovery period of 3-, 5-, 7-, or 10-years, placed in service after 2017, the default depreciation method is GDS 200% declining balance. For the same property, an election can be made to shift depreciation method to GDS 150% declining balance, GDS straight line, or ADS straight line.

For farm property with a recovery period of 15- or 20-years, the default depreciation method is GDS 150% declining balance. For the same property, an election is available to depreciation using GDS straight line or ADS straight line.

An election to change the depreciation method applies to all property within a class. For example, electing to depreciate 7-year property using GDS straight line applies to all 7-year property placed in service in that year. This election would not change the depreciation method for 5-year property placed in service that year. A different election can be made for each class of property.

§179 Expense Deduction

An election is available, using §179 expense deduction, to recover part or all of the cost of qualifying assets purchased for use in a trade or business in the year the property was placed in service. This election is made separately for each item of property placed in service in the year, and allows significant flexibility in tax planning, as the taxpayer chooses the deduction amount (up to the total basis of the property).

To qualify for §179 expense deduction, the property generally must be tangible personal property. Agricultural machinery and equipment, livestock used for draft, breeding, or dairy purposes, grain storage facilities, single purpose livestock and horticultural structures, and field tile all qualify for §179 expense deduction. General-purpose agricultural buildings, such as a machine shed or farm shop (GDS 20-year recovery period) do not qualify for the §179 expense deduction. The property must be purchased, but either new or used assets can be expensed.

The §179 expense deduction is subject to several limits, the first of which is a dollar limit that is annually adjusted for inflation. For 2024, the dollar limit is $1,220,000. In addition, the deduction is limited to business income, which will generally include wages earned as an employee, farm or non-farm business income, certain income from a passthrough entity, and gain from the sale of business property (excluding the sale of land). Finally, §179 expense deduction is subject to an investment limit. If the total cost of property qualifying for the §179 expense deduction exceeds the investment limit ($3,050,000 for 2024), the dollar limit reduced by $1 for every $1 above the investment limit.

Example 6: In 2024, Paige purchased several new pieces of equipment for her farming operation, all of which qualified for §179 expense deduction. She elected out of special depreciation allowance. The total cost of all equipment was $1,500,000 and her business income was $2,000,000. Because of the dollar limit, she will be able to elect to expense $1,220,000 using the §179 expense deduction. The remaining $280,000 will be depreciated using the 200% declining balance method unless she makes an election to change depreciation method.

If the farming business is conducted using a pass-through entity, such as a partnership or S-corporation, the §179 deduction limits first apply at the entity level, then they are applied at the individual level.

Other §179 expense deduction limits may apply to sport utility vehicles or to listed property subject to the §280F depreciation limits.

Special Depreciation Allowance (Bonus Depreciation)

Special depreciation allowance, often referred to as bonus depreciation, allows agricultural producers to deduct a percentage of the basis of property in the year the property is placed in service. For 2024, the special depreciation allowance rate is 60% and will be 40% in 2025.

Special depreciation allowance applies to property acquired by purchase, either new or used, that has a GDS recovery period of 20-years or less. Thus, agricultural machinery and equipment, livestock used for draft, breeding, or dairy purposes, grain storage facilities, single purpose livestock and horticultural structures, field tile, and general-purpose farm buildings, like machinery sheds, qualify for special depreciation allowance.

Special depreciation allowance applies to qualifying property by default, so a taxpayer must elect to not deduct the special depreciation allowance. The election out of special depreciation allowance applies to all property within a class, making it less flexible compared to §179 expense deduction for planning purposes. If the election out is made for GDS 7-year property, it applies to all GDS 7-year property placed in service that year. A different election can be made for each class of property.

Example 7: In 2024, Blair purchased 10 beef cows for $15,000 and a used swather for $40,000. Because the cows have a recovery period (5-years) that is different than the used swather (7-years), she can elect out of special depreciation allowance for the cows but still take special depreciation allowance for the swather.

Note that §179 expense deduction is taken before special depreciation allowance.

Some Planning Considerations

Elections related to depreciation methods, §179 expense deduction, or special depreciation allowance can be made after the close of the tax year, providing flexibility in income tax planning.

In addition, the accelerated nature of either §179 expense deduction or special depreciation allowance means that fewer depreciation deductions will be available in the future. Taxpayers will need to evaluate the benefit of a current depreciation deduction versus lower deductions in the future.

Caution should be used when accelerating depreciation on property that has been financed. This results in a situation where a deduction has been taken on an item that has not yet been paid for.

Finally, differences between federal and state depreciation rules can further complicate tax planning and management.

Depreciation Differences

Agricultural producers have a number of options available for depreciation, so careful consideration should be given to depreciation elections made in the year property is placed in service. The flexibility afforded in the first year can have a significant impact on years following.

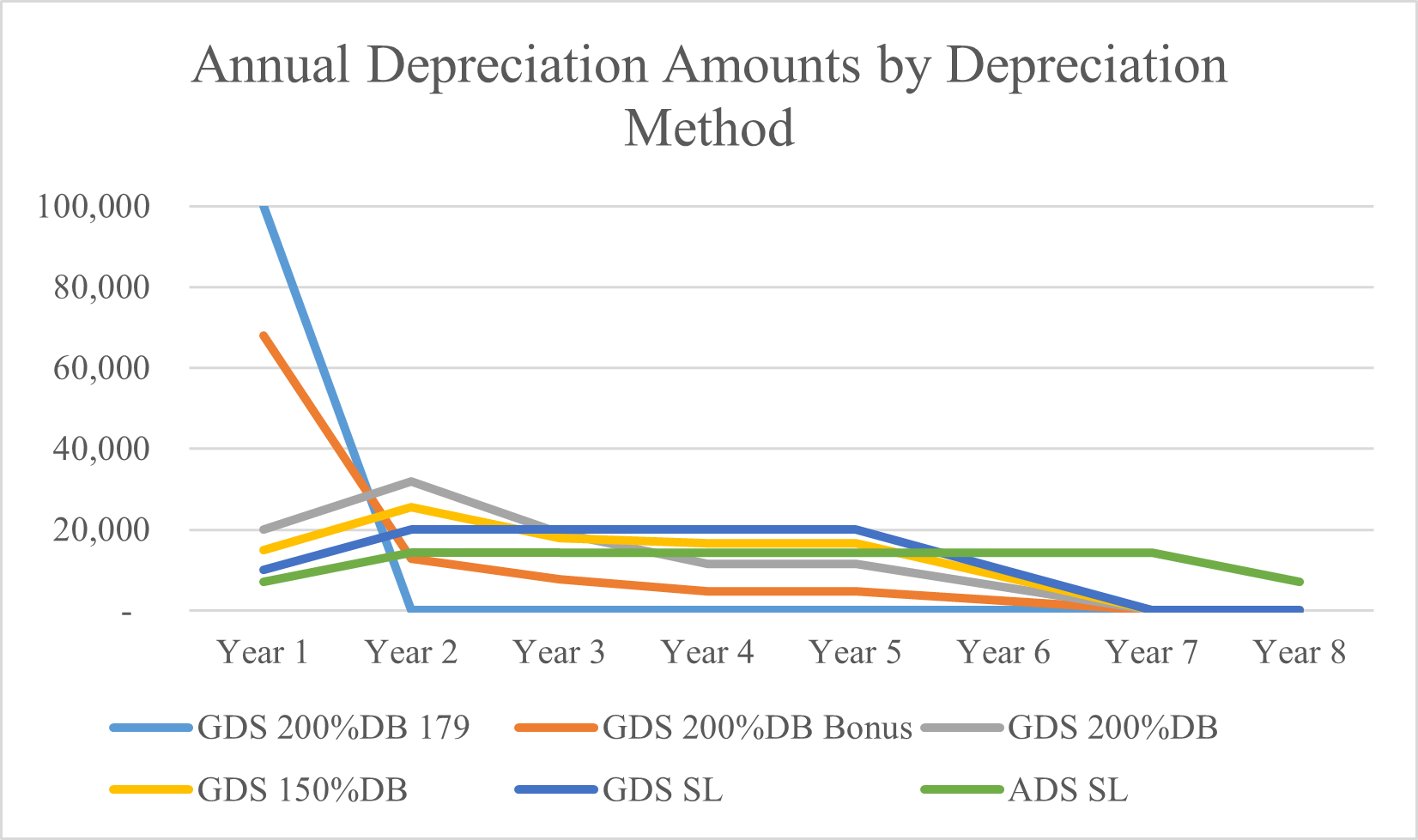

Example 7: Shelli purchases a new tractor for $100,000. She discusses potential options for depreciation with her tax preparer. Her preparer lets her know that options in the first year range from $7,140 using ADS straight line to $100,000 if she elects to deduct the full cost using §179 expense deduction. The table below shows the depreciation deduction for the tractor in each year throughout its life.

|

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

Year 6 |

Year 7 |

Year 8 |

|

|

§179 Deduction |

100,000 |

|

|

|

|

|

|

|

|

60% Bonus + GDS 200DB |

68,000 |

12,800 |

7,680 |

4,608 |

4,608 |

2,304 |

|

|

|

GDS 200DB |

20,000 |

32,000 |

19,200 |

11,520 |

11,520 |

5,760 |

|

|

|

GDS 150DB |

15,000 |

25,500 |

17,850 |

16,660 |

16,660 |

8,330 |

|

|

|

GDS SL |

10,000 |

20,000 |

20,000 |

20,000 |

20,000 |

10,000 |

|

|

|

ADS SL |

7,140 |

14,290 |

14,290 |

14,280 |

14,290 |

14,280 |

14,290 |

7,140 |

IRS Publications

To access IRS Publications, go to www.irs.gov and click on “Forms and Publications.” Then click on “Publication number” under “Download forms and publications by.” Type the publication number in the find box to search for the publication. Publications may be viewed online or downloaded by double clicking on the publication.

Additional Topics

This fact sheet was written as part of Rural Tax Education, a national effort including Cooperative Extension programs at participating land-grant universities to provide income tax education materials to farmers, ranchers, and other agricultural producers. For a list of universities involved, other fact sheets and additional information related to agricultural income tax please see RuralTax.org.

This information is intended for educational purposes only. You are encouraged to seek the advice of your tax or legal advisor, or other authoritative sources, regarding the application of these general tax principles to your individual circumstances. Pursuant to Treasury Department (IRS) Circular 230 Regulations, any federal tax advice contained here is not intended or written to be used, and may not be used, for the purpose of avoiding tax-related penalties or promoting, marketing or recommending to another party any tax-related matters addressed herein.

USDA is an equal opportunity provider, employer, and lender. Rural Tax Education is part of the National Farm Income Tax Extension Committee. The land-grant universities involved in Rural Tax Education are affirmative action/equal opportunity institutions.

This material is based upon work supported by the U.S. Department of Agriculture, under agreement number FSA21CPT0012032. Any opinions, findings, conclusions, or recommendations expressed in this publication are those of the author(s) and do not necessarily reflect the views of the U.S. Department of Agriculture. In addition, any reference to specific brands or types of products or services does not constitute or imply an endorsement by the U.S. Department of Agriculture for those products or services.

Published June 2024