Quick Guide to Extension Impacts: Finance

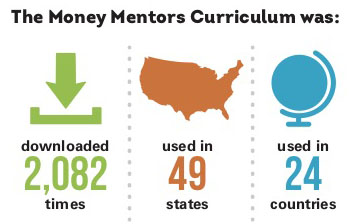

Money Mentors Curriculum Helps Youth

Financial literacy is imperative for youth if they are to become money-savvy adults. USU Extension 4-H provides a curriculum to teach youth these crucial financial skills. The Utah 4-H & Fidelity Investments® Money Mentors Youth Financial Literacy Curriculum consists of six 1-hour lessons that incorporate the do, reflect, apply method of learning through experience. The framework for the lessons includes icebreaker introductions, lesson materials and activities, wrap up/recap of each concept, and homework assignments. The six lessons in the Money Mentors curriculum are: Planning for Success; Creating a Spending Blueprint, Save Your Bacon; Share Your Bacon, Credit: Know Your Stuff, Discover a Dollar’s Potential, and Invest in Yourself. To learn more about Money Mentors and to download the curriculum, visit utah4h.org/discover.

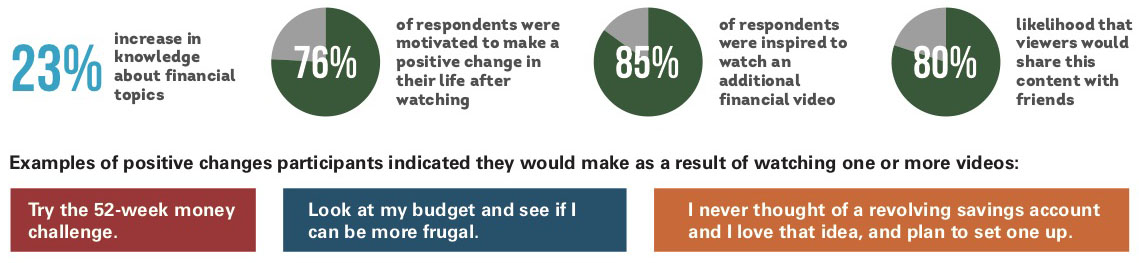

YouTube Videos Motivate Financial Change

YouTube videos have been a useful medium for distributing financial information. USU Extension’s family finance video playlist contains 23 videos about common financial topics such as debt management, credit management, and budgeting, etc.

A study of those who watched the personal finance videos was conducted through a

Qualtrics survey link. The 484 respondents collectively watched 1,102 personal finance videos in a 1-month time frame.

Watch all the Extension family finance videos here.

Results indicated:

Our Utah State University Extension family and consumer sciences faculty help individuals and families understand and take steps to achieve financial security. Those who do not have the necessary skills to stretch their limited resources are particularly vulnerable to financial instability. To reach our many audiences, Extension provides a variety of delivery methods for our finance programs: face-to-face, online classes, websites, apps, blog posts, educational videos, Facebook Live events, social media outreach, and TV, magazine, and news articles. Through these methods, we provide research-based education in financial resource management to fulfill the Extension mission of extending university resources to the communities we serve. We hope you enjoy learning about our financial programs! Visit our new personal and family money management websites finance.usu.edu[BROKEN LINK] and UtahMoneyMoms.com.

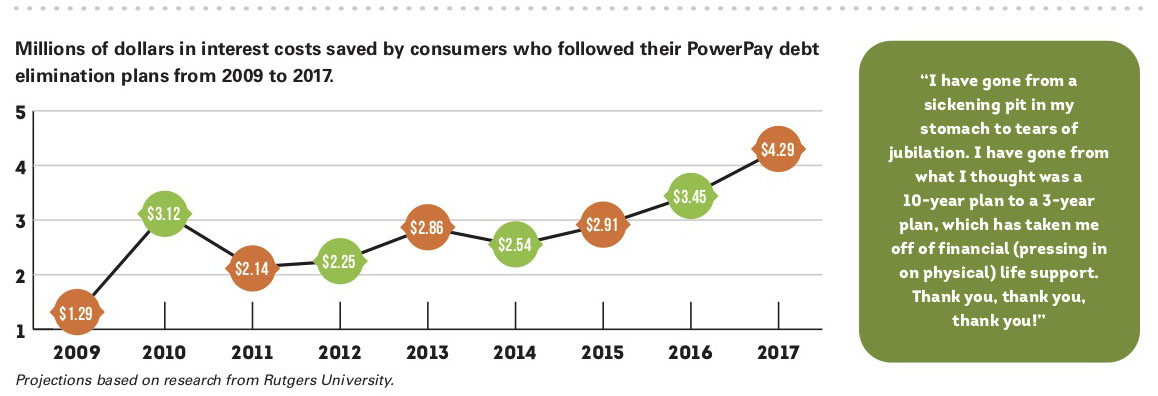

PowerPay Helps Users Save Millions in Interest

The consumer finance website, The Balance, reports that 38 percent of American households carry credit card debt from month to month, with an average balance of $7,527.

PowerPay.org, a free website and mobile app, was developed by USU Extension for such consumers to enable them to develop a self-directed debt elimination plan. The site shows consumers how much they can save in interest costs and how much more quickly they can be debt free by following a specific plan and by incurring no new debt and rolling over debt payments to other obligations as debts are paid off.

The site averages 125,000 visits each year with 77 countries having 10 or more visits. It has been used by 126 military bases worldwide and 45 land-grant universities. More than 90 websites have recommended their visitors use the PowerPay site. Sign up for the benefits of PowerPay at PowerPay.org.

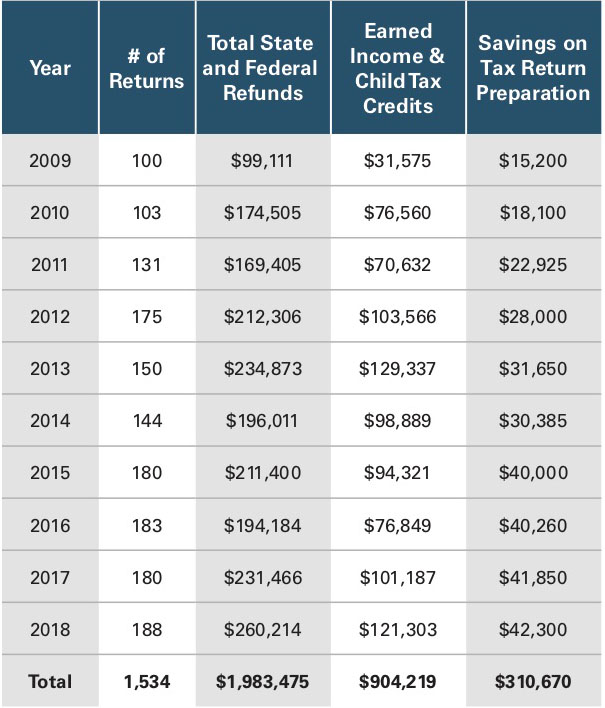

Vita Helps Low-Income Families Earn Tax Credits

There are many low-income households in Utah that qualify for poverty-fighting tax credits (Earned Income and Child Tax). However, in many instances, these families are less familiar with the relevant tax codes and can’t afford to pay for professional assistance. In addition, some reside in rural areas with limited access to tax assistance.

Ten years ago, USU Extension developed the Virtual Volunteer Income Tax Assistance (VITA) program and pioneered the concept of connecting rural taxpayers with urban-area certified preparers via the internet. The program helps low-income households receive the deductions they qualify for and greatly expands rural access to tax assistance. The process is now fully endorsed and promoted by the IRS.

The program requires that participants have direct contact with certified volunteers trained in tax preparation. Urban areas have larger volunteer pools to draw from, resulting in more readily available sites in urban versus rural areas.

USU Extension directs the Virtual VITA program in three counties (Grand, Summit, and Wasatch) and has helped establish VITA sites in seven others.

To learn more visit utahtaxhelp.org.

Financial Courses Teach Important Basics

Many people struggle with spending and budgets because of behavioral patterns that may have been in place for years. Change Makes Cents is a series of financial education lessons developed by Extension professionals that focus on setting goals for personal financial behavior change. The series offers four lessons: budget basics, credit 101, getting organized, and avoiding debt.

In a 3-year period, the Change Makes Sense series has been used more than 20 times. Organizations that have used Change Makes Sense include Workforce Services, community churches and state Extension services.

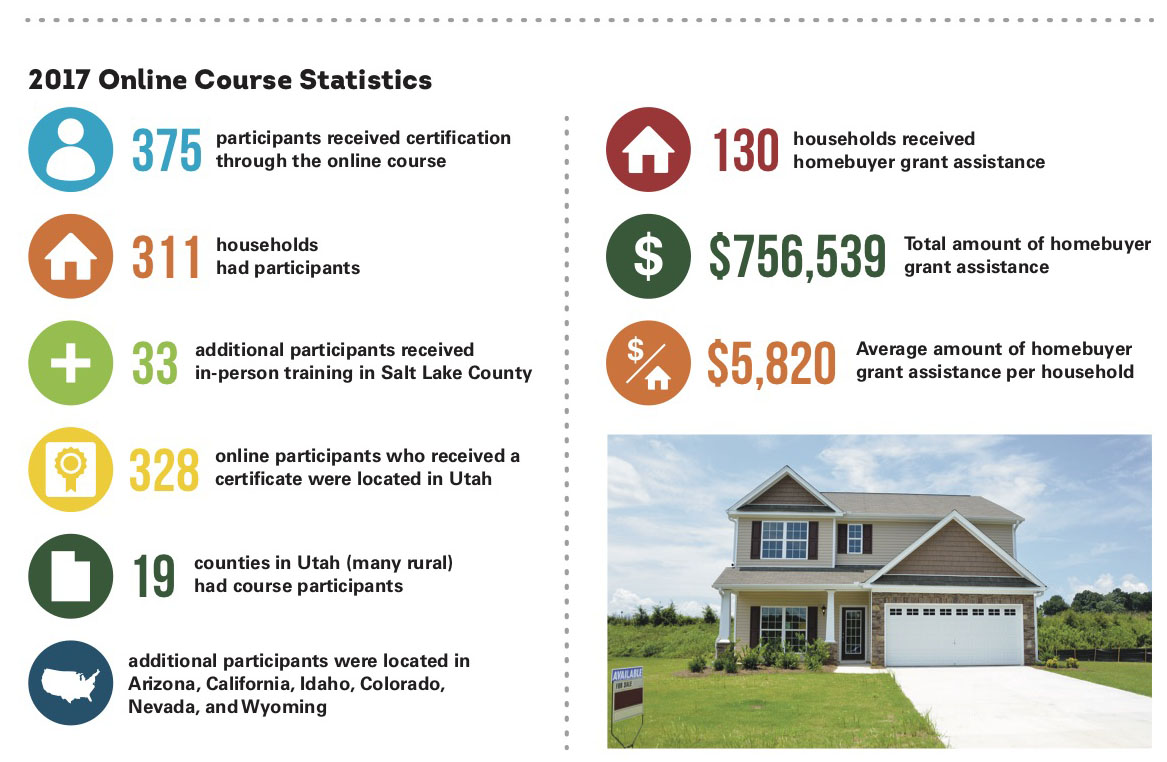

Online Course Assists First-Time Homebuyers

First-time homebuyers often don’t know how much house they can afford and are sometimes taken advantage of as they navigate the home-buying/financing process.

Studies show that homeowners who receive education before purchasing are less likely to default on their home loans. The U.S. Department of Housing and Urban Development (HUD) recognizes the need for homebuyer education, and the USDA Rural Housing Loan Services and others offering low-interest loans require that first-time borrowers attend an in-person course before they can qualify for a loan. USU Extension implemented HUD certified, first-time home- buyer courses in Salt Lake and Weber counties. This worked well for those areas, but there were still many people around the state who couldn’t attend classes in these locations in person.

To resolve this issue, an online HUD-approved, first-time homebuyer education course was created by USU Extension in 2005 for residents in Utah and other states. In January 2018, USU Extension was designated one of three nationally approved online homeownership education providers approved for national use by USDA Rural Housing clients. The course has been successful because home- buyers can take it at their convenience. Completing the training and receiving the certificate also qualifies them for low-interest loans and home-ownership assistance grants to help them get into a home they can afford.

Visit extension.usu.edu/hbe for more information.

Utah 4-H & Youth

Utah 4-H & Youth