Fruit Production and Opportunities for Growers in Utah

Introduction

Utah’s long history of cultivating fruit started with native American communities long ago (Wytsalucy, 2019). Fruit production efforts continued under pioneer settlers in the mid-1800s, and the industry has evolved substantially since those early farming roots were established. Although agriculture is no longer the primary industry in Utah as it was in the 1800s, fruit production is still a significant part of Utah’s economy (Powell & Wood, 1995). Hay and alfalfa are currently Utah’s main crops, with alfalfa production valued at $435 million in 2023. The top five fruits grown in Utah produce $17.8 million for the state annually, and the state’s tart cherry crop alone was valued at $7.9 million in 2023 (National Agriculture Statistics Service [NASS], 2023b; Hilton, 2019).

Apples, peaches, cherries, pears, apricots, and grapes were the most popular fruit products when Utah was first settled by pioneers (Powell & Wood, 1995). Small, private operations that grew many varieties were typical in the state's early history; a commercial fruit industry wasn’t established until the early 1900s. Peaches and apples competed in popularity until tart cherries surpassed them both in the 1960s. As tart cherries became more popular as a reliable source of income for growers, other fruit varieties became less common in Utah’s fruit industry (Powell & Wood, 1995).

Today, most of the fruit produced in Utah is grown along the Wasatch Front. Utah County grows half of the fruit produced in the state, followed by Box Elder County, and Weber and Davis counties, respectively (Feuz & Larsen, 2020). Before urban expansion, Salt Lake and Washington counties were also major fruit producers (Powell & Wood, 1995).

This fact sheet discusses the state of the fruit industry in Utah, its impact on the Utah economy, as well as current challenges the fruit industry faces and opportunities for fruit growers moving forward. These challenges and opportunities underscore the importance of fruit to the state’s economy, as growers navigate urbanization, competition, and consumer preferences for locally grown produce. Fostering collaboration between consumers and growers will ensure a commitment to local agriculture and community support.

Fruit Production in Utah

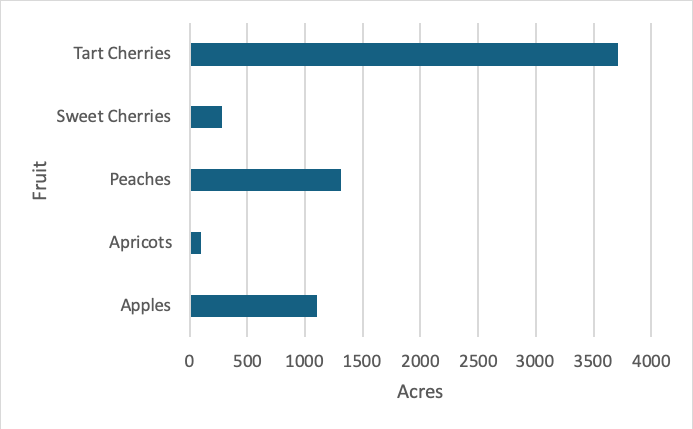

Tart cherries, sweet cherries, apples, peaches, and apricots are commonly grown fruits in Utah today (Feuz & Larsen, 2020; Hilton et al., 2019; O’Donoghue, 2023). Utah ranks second in the nation for tart cherry production after Michigan (Hilton, 2019). In 2022, 3,700 acres in Utah were dedicated to tart cherry production, producing more than 22.6 million pounds of tart cherries— more than any other fruit grown in the state (NASS, 2022) (see Figure 1). Peaches are second to tart cherries in both acres cultivated and tons of fruit produced, as 1,310 acres were cultivated in Utah in 2022. Fewer acres are dedicated to apple production, as only 1,104 acres were cultivated in 2022. Only 100 acres are used to cultivate apricots in the state. Sweet cherries are also a smaller crop, with 285 acres in production.

Figure 1. Utah Fruit Production in Acres (2022)

Fruit Industry Economic Impacts

Although tart cherry production is the highest among fruits produced in Utah, annual pricing has varied from $0.15 per pound in 2019 to $0.51 per pound in 2012 (NASS, 2023a) (see Table 1). Tart cherries are produced in large volumes annually, ranging from 23 to 52 million pounds in recent years. While tart cherries are Utah’s most valuable fruit, variability in production and pricing have led to similar variability in total production value ranging from $5 to $9 million in the last five years (see Table 1).

| Year | Bearing acreage | Total production (million pounds) | Price per pound (dollars) | Value of production (million) |

|---|---|---|---|---|

| 2009 | 3,300 | 47 | 0.270 | $9.18 |

| 2010 | 3,300 | 23 | 0.270 | $6.07 |

| 2011 | 3,300 | 35 | 0.290 | $10 |

| 2012 | 3,300 | 40 | 0.510 | $20.4 |

| 2013 | 3,300 | 26.8 | 0.476 | $12.76 |

| 2014 | 3,300 | 51 | 0.432 | $21.5 |

| 2015 | 3,300 | 40.7 | 0.336 | $13.53 |

| 2016 | 3,300 | 52.8 | 0.353 | $17.53 |

| 2017 | 3,300 | 26 | 0.304 | $7.6 |

| 2018 | 3,100 | 45 | 0.222 | $9.1 |

| 2019 | 3,000 | 54 | 0.156 | $6.67 |

| 2020 | 3,100 | 29 | 0.165 | $4.57 |

| 2021 | 2,900 | 33 | 0.254 | $8.49 |

| 2022 | 3,100 | 22.6 | 0.257 | $5.63 |

Fresh apples also have a relatively low price point, coming in at $0.22 per pound and generating $5 million for the state in 2014 (see Table 2). This lower price point means that although an equal number of acres were dedicated to each in 2014, and apples produce more tons of fruit, peaches are Utah’s second most valuable crop, also valued near $6 million. The higher value of Utah’s peach crop is due to its higher price per pound, coming in at $0.49 per pound (2014).

Utah’s apricots are valued slightly higher at $0.76 per pound, giving apricots the highest value per pound among fruits grown in Utah in 2014. Despite this higher price per pound, the annual production of apricots is limited to only 228 tons annually, resulting in a yearly revenue of just $330,000. The sweet cherry crop produces $1.2 million annually; sweet cherries bring in $0.43 per pound (2014).

| Fruit | Bearing acreage | Total production (million pounds) | Price per pound (dollars) | Value of production (million) |

|---|---|---|---|---|

| Apples | 1,300 | 23 | 0.219 | $4.90 |

| Apricots | 120 | .46 | 0.76 | $0.33 |

| Sweet cherries | 400 | 1.68 | 0.43 | $1.20 |

| Tart cherries | 3,300 | 51 | 0.432 | $21.5 |

| Peaches | 1,300 | 13 | 0.49 | $6.10 |

Note. 2014 was the last year values for all fruits were calculated by USDA NASS.

Source: Hilton et al., 2019.

Challenges and Opportunities for Utah's Fruit Industry

Fruit growers in Utah face competition from both domestic and imported products (Knudsen, 2015). Major importers of tart cherries, such as Turkey, may sell their products below the cost of production. This practice can drive down prices for local growers, making it difficult for them to compete (Fruit Growers News [FGN], 2020; Galloway, 2021). Despite the impacts of cherry imports to U.S. growers, the International Trade Commission ruled that lower-priced imports don’t harm the domestic industry (FGN, 2020).

A major concern for Utah’s fruit growers is the loss of agricultural land due to urban development. Prime agricultural land is increasingly being converted into residential or commercial areas, especially along the Wasatch Front. As available farmland decreases, Utah loses farms each year (18,409 farms in 2017 compared to 17,400 in 2023; NASS, 2024), and the average farm size also diminishes. Smaller farms often face profitability challenges and may pivot towards niche markets to sell their products at premium prices (Knudsen, 2015). Growers may sell their products with specialty labels such as organic, locally grown, eco-friendly, or pesticide-free, or they may choose to use direct-to-consumer markets that allow them to retain a higher proportion of profits from fruit sales (Capelli et al., 2022; Curtis et al., 2020; Dumont, 2017). While contracts can provide growers with price stability for their fruit, small producers may find it challenging to find buyers willing to engage in contractual agreements.

Organic food sales have increased in recent decades, demonstrating consumer interest in organic products, particularly organic fruits and vegetables (Curtis et al., 2020). Organic food sales reached $52 billion in 2021, up from $26.9 billion in 2010 (Economic Research Service [ERS], 2023). Research demonstrates that consumers are willing to pay more for organic products over conventional products and that environmental concerns are primary motivators in consumers’ willingness to pay higher premiums for organic products (Curtis et al., 2018). Various studies have found that consumers may be willing to pay 30%–150% more for organic products over conventional products; this wide range in premiums may be due to the differences in study samples of consumer groups and the products evaluated (Curtis et al., 2020).

To be labeled as organic, products must adhere to regulations set by the U.S. Department of Agriculture (Agricultural Marketing Service [AMS], 2019). Organic production can cost more than conventional production methods, decreasing the profit margin for organic producers despite the premium pricing (Curtis et al., 2018).

Producers may adhere to some of the practices required for organic labeling, but not all of them. Other labels such as eco-friendly, pesticide-free, or integrated pest management (IPM) are not well defined or regulated. Producers who choose to use one or more of these practices can label their products accordingly and still sell their fruit at premium prices without being certified organic (Curtis et al., 2018).

Consumers with strong environmental concerns have been found to be more interested than their peers in sustainable attributes such as reduced pesticide use or non-GMO. By labeling their products with sustainable attributes and educating consumers about their environmental benefits, producers can sell their fruit at higher premiums compared to conventionally grown fruit (Curtis et al., 2020).

Consumers are also interested in local products (Cappelli et al., 2022; Dumont, 2017). Consumers often perceive locally produced food as more environmentally friendly, tastier, and of superior quality compared to items transported long distances from elsewhere. The demand for local products has increased in recent years as demonstrated by the increases in farmers markets in Utah and nationally, which doubled from 2008 to 2017 (Curtis et al., 2020).

All 50 states have a state labeling program for products produced or grown in the state (Knudsen, 2015). In Utah, products may be labeled as “Utah’s Own” if growers and food makers sign up for the program and meet the requirements (Utah’s Own, n.d.). While there is no set definition of what “counts” as local, geographic boundaries such as in-state or within 400 miles are common guidelines (Capelli et al., 2022). Despite this, research finds that there are consumer segments willing to pay premiums for products grown locally or in-state (Capelli et al., 2022).

Local fresh produce doesn’t have to travel extended distances to reach consumers, so it is often picked at the peak of ripeness and thus is often fresher (Klavinski, 2013; McCurdy, 2022). Less transportation may also mean reduced emissions moving produce from farms to consumers (Capelli et al., 2022; Klavinski, 2013; McCurdy, 2022). Also, when consumers purchase products grown locally, their money is more likely to stay locally and be reinvested in the community (Dumont, 2017).

Outside of any local or specialty labeling programs, producers may retain more profits by selling their fruit directly to consumers. Direct-to-consumer marketing methods include farmers markets, community-supported agriculture (CSA) subscriptions, and farm stores or stands (Knudsen, 2015). As each direct-to-consumer market has advantages and disadvantages, some may work better than others, and operations often utilize multiple markets. Producers should determine their needs and resources before determining how to sell their products either wholesale or direct-to-consumer (Curtis et al., 2018).

Conclusions

Although much has changed since fruit trees were first cultivated in Utah, fruit continues to be an important part of Utah’s economy. As new challenges arise and fresh opportunities emerge, the industry will continue to evolve. While urbanization and competition from other domestic and international producers present obstacles for growers, by tapping into consumer markets for locally grown fruits and labeling their products as such, growers can successfully market their products for premium prices.

Additionally, when Utah consumers support local growers, their money remains in the state and supports their communities (Dumont, 2017). Many consumers perceive local produce as fresher and of better quality compared to produce shipped from distant locations. The perception that locally grown fruit is higher quality and fresher than non-local fruit shows that Utah consumers value fruit grown in the state and are interested in supporting local farmers. The increase in the number of farmers markets and CSA programs in recent years demonstrates a growing consumer demand for local foods. Connecting the consumers who value locally grown fruit with fruit growers is key. When consumers and growers in Utah collaborate, it’s a win-win situation for everyone involved.

Acknowledgments

This material is based upon work that is supported by the National Institute of Food and Agriculture, U.S. Department of Agriculture, under award number 2020-38640-31523 through the Western Sustainable Agriculture Research and Education program under project number SW21-923. USDA is an equal opportunity employer and service provider. Any opinions, findings, conclusions, or recommendations expressed in this publication are those of the author(s) and do not necessarily reflect the view of the U.S. Department of Agriculture.

References

- Agricultural Marketing Service. (2019). About the organic standards. U.S. Department of Agriculture. https://www.ams.usda.gov/grades-standards/organic-standards

- Curtis, K. R., Drugova, T., Knudsen, T., Reeve, J., & Ward, R. (2020). Is organic certification important to farmers’ market shoppers or is eco-friendly enough? HortScience, 55(11), 1822–1831. https://doi.org/10.21273/hortsci15291-20

- Curtis, K., S. Allen, & Slocum, S. (2018). Fresh produce direct marketing sales considerations [Fact sheet]. Utah State University Extension. https://extension.usu.edu/apec/files/uploads/Fresh_Produce_DM_Sales_Considerations.pdf

- Dumont, A. (2017, December 5). The economic impact of locally produced food. Federal Reserve Bank of St. Louis. https://www.stlouisfed.org/on-the-economy/2017/december/economic-impact-locally-produced-food

- Economic Research Service. (2023, February 13). Organic agriculture: Overview. U.S. Department of Agriculture. https://www.ers.usda.gov/topics/natural-resources-environment/organic-agriculture/

- Feuz, R., & Larsen, R. (2020). Size and scope of Utah agriculture 2019 [Fact sheet]. Utah State University Extension. https://digitalcommons.usu.edu/extension_curall/2112/

- Fruit Growers News. (2020, February 11). Cherry imports from Brazil, Turkey questioned by senator. https://fruitgrowersnews.com/news/cherry-imports-from-brazil-turkey-questioned-by-senator/#:~:text=In%202018%2C%20the%20U.S.%20government

- Galloway, M. (2021, January 29). Michigan cherry growers call ‘checkmate’ on Turkey imports. Michigan Farm News. www.michiganfarmnews.com. https://www.michiganfarmnews.com/michigan-cherry-growers-call-checkmate-on-turkey-imports

- Hilton, J. (2019, November 1). Agriculture in the Beehive State. U.S. Department of Agriculture. https://www.usda.gov/media/blog/2019/11/01/agriculture-beehive-state

- Hilton, J., Gentillon, J., Hamer, H., Joshua, T., Operations, W., & Meyer, W. (2019). 2019 Utah agricultural statistics and annual summary report. Utah Department of Agriculture and Food and United States Department of Agriculture, National Agricultural Statistics Service, Mountain Region, Utah Field Office. https://ag.utah.gov/wp-content/uploads/2019/09/2019-Utah-Agricultural-Statistics-and-Annual-Summary.pdf

- Homeland Security & Governmental Affairs. (2020, February 11). Peters calls for investigation into suspicious cherry import practices from Brazil and Turkey. U.S. Senate Committee on Homeland Security & Governmental Affairs. https://www.hsgac.senate.gov/media/dems/peters-calls-for-investigation-into-suspicious-cherry-import-practices-from-brazil-and-turkey/

- Klavinski, R. (2013, April 13). 7 benefits of eating local foods. Michigan State University Extension. https://www.canr.msu.edu/news/7_benefits_of_eating_local_foods

- Knudsen, T. (2015). Economic assessment of organic, eco-friendly, and conventional peach production methods in Northern Utah [Master’s thesis, Utah State University]. All Graduate Theses and Dissertations. https://digitalcommons.usu.edu/etd/4019

- McCurdy, M. (2022, May 17). Health benefits of eating locally [Fact sheet]. University of New Hampshire Extension. https://extension.unh.edu/blog/2022/05/health-benefits-eating-locally

- MyPlate. (2020). Fruits. U.S. Department of Agriculture (USDA). https://www.myplate.gov/eat-healthy/fruits

- National Agricultural Statistics Service (NASS). (2022). Census of agriculture for Utah, Specified fruits and nuts by acres: 2022 and 2017. U.S. Department of Agriculture. https://www.nass.usda.gov/Publications/AgCensus/2022/Full_Report/Volume_1,_Chapter_1_State_Level/Utah/st49_1_037_037.pdf

- NASS (2023a). Non citrus fruits and nuts 2022 summary. U.S. Department of Agriculture. https://downloads.usda.library.cornell.edu/usda-esmis/files/zs25x846c/zk51wx21m/k356bk214/ncit0523.pdf

- NASS. (2023b). 2023 state agriculture overview - Utah. U.S. Department of Agriculture. https://www.nass.usda.gov/Quick_Stats/Ag_Overview/stateOverview.php?state=UTAH

- NASS. (2024, February 16). Farms and land in farms - 2023 [Press release]. U.S. Department of Agriculture. https://www.nass.usda.gov/Statistics_by_State/Utah/Publications/News_Releases/2024/UT-Farm-Numbers-02162024.pdf

- O’Donoghue, A. J. (2023, July 28). Tart cherry production: Little tasty fruit is grown big time in Utah. Deseret News. https://www.deseret.com/2023/7/28/23809958/utah-county-tart-cherry-production-tasty-fruit-utah-agriculture-cherry-marketing-institute

- Powell, A. K., & Wood, S. R. (1995). Utah history encyclopedia (pp. 207–208). University Of Utah Press. https://eds-p-ebscohost-com.dist.lib.usu.edu/eds/ebookviewer/ebook?sid=0db58ede-e7c2-4163-ad83-3abec836ec0c%40redis&vid=0&format=EB

- Utah's Own. (n.d.). Utah’s Own, discover local food. Utah Department of Agriculture and Food. Retrieved January 29, 2024, from https://utahsown.org/

- Wytsalucy, R. (2019). Explorations and collaborations on two under-recognized Native American food crops: Southwest peach and Navajo spinach [Master’s thesis, Utah State University]. All Graduate Theses and Dissertations. https://digitalcommons.usu.edu/cgi/viewcontent.cgi?article=8745&context=etd

July 2024

Utah State University Extension

Peer-reviewed fact sheet

Authors

Makaylie Langford, USU Extension Intern, Department of Applied Economics

Kynda Curtis, Professor and USU Extension Specialist, Department of Applied Economics