Cow-Calf Retained Ownership Analysis and Price Forecasting Using an Online Decision-Support Tool

Introduction

Cow-calf producers must frequently decide to either sell their calves at weaning (or soon thereafter) or retain ownership of the calves through a background/growing phase (typically on harvested forages, pasture, corn stalks, or other crop residues). Then, the cattle are sold or retained in a finishing feedlot program. While the price producers might receive at weaning may be known, there is great uncertainty about what cattle prices might be at the end of the retained ownership program. The sale date may be 60 to over 200 days in the future—and much can change in that time. Uncertain prices lead to uncertain returns, which discourages many producers from considering retained ownership.

There are opportunities in Utah for cow-calf producers to retain ownership on their own farm/ranch or a neighbor’s place. There are also opportunities to retain ownership of calves in more distant locations. For example, calves may be retained in California on winter grass pastures, Oklahoma on wheat pastures, Nebraska on corn stocks, or in Colorado at a background yard. There may be uncertainty in finding partners in other states whose pasture, background, or feedlot operations are a good fit for a producer’s cattle and management/marketing goals.

This fact sheet’s two main objectives are to:

- Explain a method for reducing some of the uncertainty with cattle prices when the sale will occur months in the future.

- Introduce a web-based decision-support tool to help cattle producers quickly analyze the potential returns and risks from various retained ownership alternatives.

1. Reducing Uncertainty: Future-Based Price Forecasts

What is the best way to predict or forecast cattle prices for next month, three months from today, or even eight months from today? One approach is to expect whatever price you last received to be the price you will next receive. This is known as a “naïve forecast,” and sometimes, it can be fairly accurate. Another is the “coffee shop method” of talking to neighbors to find a consensus on what prices might be. This method’s accuracy may depend on your “coffee shop.” Another is consulting with market experts and possibly paying fees to receive expert forecasts. Research over the last 40 years has shown that looking at Chicago Mercantile Exchange (CME) Feeder Cattle or Live Cattle futures prices and then adjusting them to your local cash price 2 level will generally provide the most accurate forecast method (Just & Rausser, 1981; Kastens et al., 1998; Poghosyan et al., 2021).

To obtain the most accurate market forecast, take the current futures market price for the time you intend to sell and adjust that by an historical fixed amount to “localize” it for the market where you plan to sell.

The futures market for cattle, like any agricultural commodity, is efficient and unbiased in the long run. The markets capture information from the last period, from multiple “coffee shops” (many individuals expressing their opinions through buying and selling the futures markets) and from the experts. No single expert or coffee shop group can consistently outperform the futures market in terms of price forecast accuracy. The most accurate forecast (identified by the three research studies already cited) tends to be obtained by taking the current futures market price for the time you intend to sell and then adjusting that by a fixed amount to “localize” it for the market where you plan to sell.

“Basis” is defined as the difference between a local cash price and the CME Feeder Cattle futures price for feeder cattle or the CME Live Cattle futures price for fed or finished cattle. The research shows that if you know the historical basis information for a given market, then your most accurate forecasts tend to be obtained by calculating the 5-year average basis and adding that number to the current CME futures price for the month in which you intend to sell.

Example

Here is a quick, practical example: Suppose it is now mid-October 2024, and you have weaned 550-pound steer calves. You planned to background these calves for 90 days and sell them in mid-January at 650 pounds. Table 1 lists the last 5-year average prices for 650-pound steers at Producers’ Livestock Auction in Salina, Utah, and the CME Feeder Cattle futures prices for January. Basis is calculated for each year, and the 5-year average basis is calculated to be:

$-1.86/cwt or $-0.0186/pound.

You look up Feeder Cattle prices from the CME website and find that the January contract is currently priced at $220.50/cwt. Using CME Feeder Cattle Futures – Quotes, you can see current prices for a specific day. Your forecast price for a 650-pound steer in Salina, Utah, is that futures price plus your historical average basis from Table 1:

$220.50 + $-1.86 = $218.64/cwt. or $2.19/pound.

Table 1. Historical January Cash Prices for 650-Pound Steers at Salina, Utah, CME Feeder Cattle (FC) Prices, and the Calculated Basis

| Year | January cash price | January CME FC price | January basis |

|---|---|---|---|

| 2019 | 142.50 | 144.32 | -1.82 |

| 2020 | 146.33 | 144.82 | 1.51 |

| 2021 | 134.53 | 136.14 | -1.61 |

| 2022 | 162.82 | 163.57 | --0.75 |

| 2023 | 179.13 | 185.77 | -6.64 |

| Average | - | - | -1.86 |

Note. All prices are in $/cwt.

How accurate will this forecast price be? You won’t know until you actually sell the steers in January. Will this retained ownership venture have a positive net return? What are your shipping costs? What could you sell the calves for in October? What are your feeding costs? How much risk is involved? The web-based decisionsupport tool described in the next section is designed to help you answer some of these questions.

2. Analyzing Potential Returns and Risks: Online Decision-Support Tool

The following web-based decision-support tool was developed to help Utah cattle producers analyze several different retained ownership alternatives: Retained Ownership Decision Tool. The tool can also be used to forecast feeder cattle prices. Producers only need to enter minimal data. The tool completes several calculations, and ultimately, net return and return variability are predicted for the retained ownership alternative.

Producers enter information about their cattle to sell or retain in a program:

- Date.

- Sex (steer or heifer).

- Cattle weights.

- Number of head to sell or retain.

- Current price if cattle were sold at that time rather than being retained.

Producers also enter data about the retained ownership alternative:

- Transportation costs.

- Expected death loss.

- Days in the retained ownership program.

- Expected weight gain.

- Expected costs for the retained ownership program.

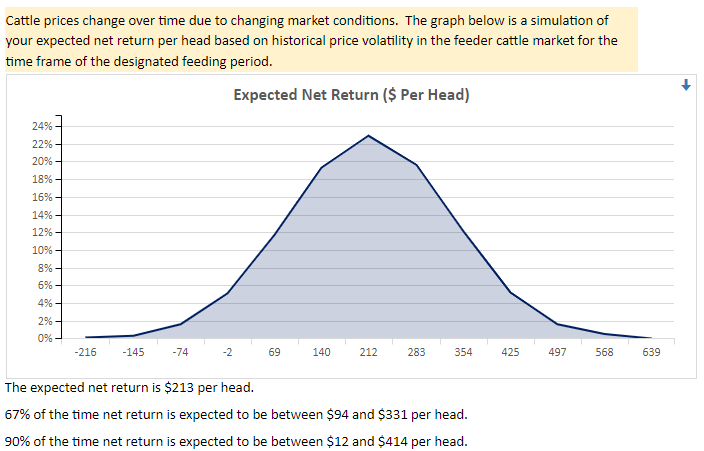

Although the prior section is rooted in the concept of basis, basis is not constant from year to year. Basis also varies from month to month, by sex and weight of feeder cattle, and from one market location to another. Futures market prices can vary up and down within a single day and over the months as market conditions change. From the start to the end of a retained ownership program, prices could easily increase or decrease by $10/cwt ($.10/pound) or more. Generally, the longer the retained ownership program, the more risk that futures prices will move much higher or much lower. The tool is based on analysis of historical basis data (adjusting for month, steer or heifer, weight, number of head sold, and market location) and futures market variability and then simulates 1,000 different market scenarios with this data. The result is an average expected return for the retained ownership scenario and a graphical and numerical estimate of how much those returns may vary from the expected return. The graph represents potential risk and depicts how much net returns could decrease or increase due to market volatility.

Budgets

The tool is designed to capture your cash (out-of-pocket) costs and provide a quick look at potential returns to assist in the retained ownership decision. It does not consider all “economic” costs (depreciation, return to management, time value of money, etc.) or how profitable it is to raise calves and sell them. Use the interactive cow-calf web-based budgets found here to answer the costs and returns questions of raising a weaned calf: Interactive Enterprise Budgeting Tools.

Tool Examples

Three examples of using the Retained Ownership Decision Tool follow.

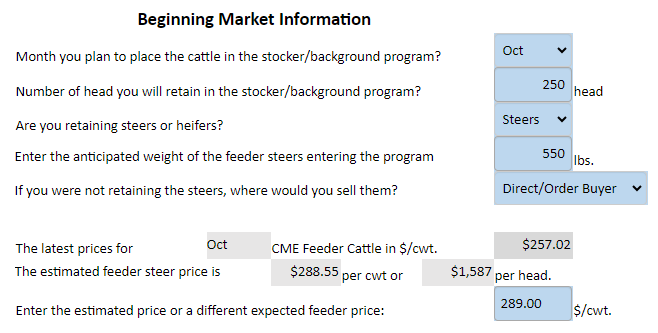

Example 1: Forecast Price

The first example is to use the tool to make a price forecast. Assume it is early May. You have just branded 250 head of steer calves that you intend to sell in mid-October to an order buyer, and you think the steers should weigh 550 pounds at that time. Figure 1 displays a screenshot from the Retained Ownership Decision Tool; you enter that information into the blue cells. The gray cells are calculated automatically by the tool using the latest two-week average of feeder cattle futures prices and historical basis data. The result is a price forecast for October of $288.55/cwt. If you only want the price forecast, you could ignore the rest of the tool.

The Retained Ownership Decision Tool is fully interactive and responsive. Changing one blue box value will automatically change all light gray values impacted by that change. For example, changing the weight, the number of head, or the sale location would all change the forecasted price.

Figure 1. Example Screenshot of the Retained Ownership Decision Tool (First Section): Fall Calf Price Forecast

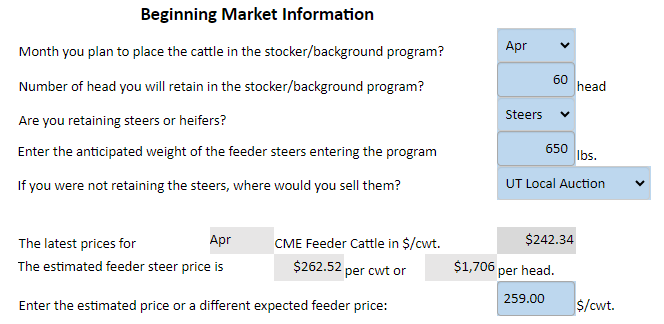

Example 2: Sell After a Summer Grass Stocker Program

The second example will be a summer grass stocker program. You live in central Utah, and you purchased 60 steers weighing 650 pounds from the Fallon, Nevada, livestock auction on April 30. You enter that information into the blue cells of the Retained Ownership Decision Tool, which gives you a projected price of $262.52/cwt (Figure 2). However, you paid $255.00/cwt at the auction and had an additional $4.00/cwt for shipping the steers to your pasture. So, you enter $259.00 into the blue cell.

Figure 2. Example Screenshot of the Retained Ownership Decision Tool (First Sections): Summer Grass

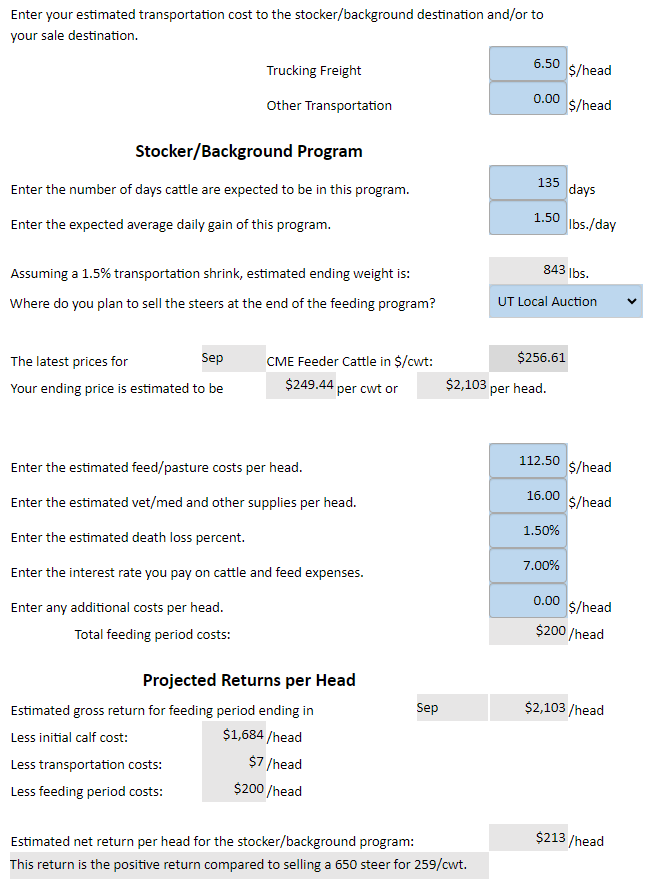

You expect $6.50 per head in freight cost to your local market at the end of the 135-day grazing program. The steers are expected to gain 1.5 pounds daily and weigh 843 pounds at the market. The tool’s forecasted midSeptember prices for these steers is $249.44 per cwt (see Figure 3). You assume a $25 per head per month grazing cost for a total grazing cost of $112.50 for the summer. Additional veterinary and medical, death loss, and interest costs result in a total summer cost of $200 per head for the steers (see Figure 3). The tool then calculates the expected net return for the summer grazing program to be $213 per head. Since the tool forecasts the price of the steers 135 days into the future, there is obviously a risk that prices will be higher or lower than forecasted. This would then alter the expected return. The tool uses historical price data to make assumptions about the probability that prices will be a certain amount higher or lower, which is displayed in the graph at the bottom of Figure 3. Specifically, the variability (standard deviation) for the relevant price series is calculated and then a normal distribution is fit around the expected mean. With this example, 90% of the time, the net return is expected to be between $12 and $414 per head.

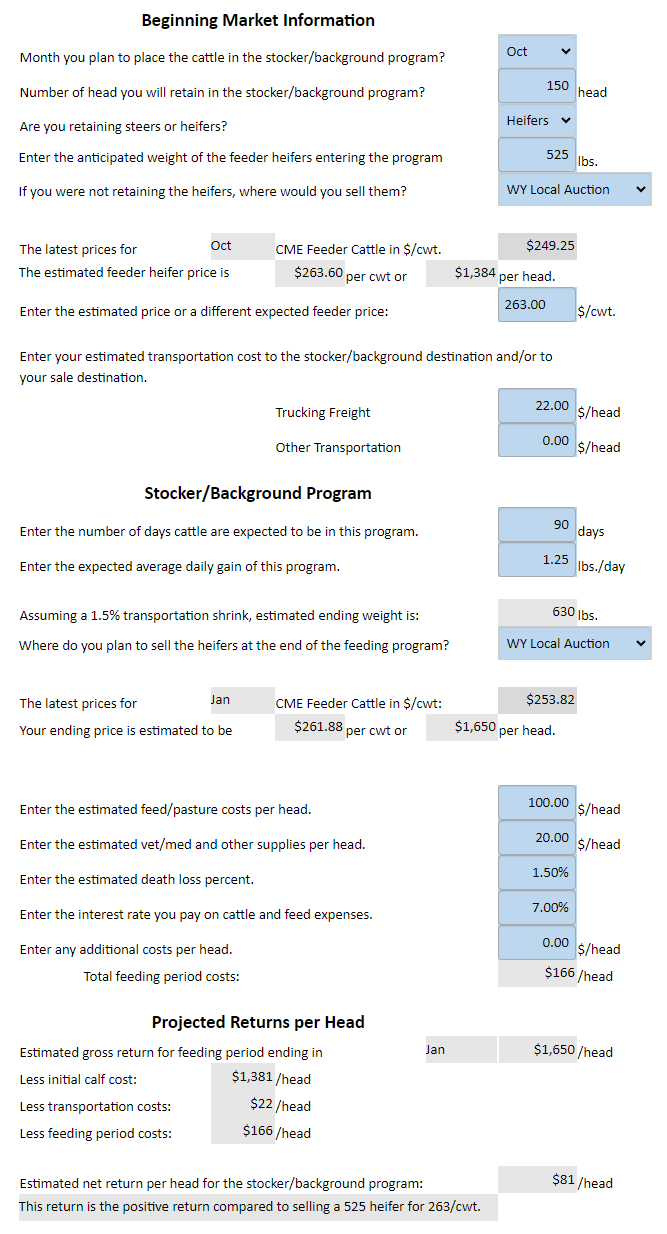

Example 3: Retain Weaned Calves to Sell Later

The final example illustrated in this fact sheet is of a producer in Northeastern Utah who is considering keeping their heifer calves for 90 days after weaning in October and selling them in mid-January. The producer typically trucks their calves to Wyoming and sells them at an auction there. The top of Figure 4 shows the beginning market information from a screenshot of the tool. Based on the weight and number of heifers to sell and the market conditions, the projected price in October at the start of the background program is $263.60 per cwt.

The heifers will be fed an alfalfa-grass hay mixture for 90 days and are expected to gain 1.25 pounds daily. Their sale weight in January is calculated to be 630 pounds. You anticipate $100 per head in feed costs and another $20 per head in veterinary and medical costs per head. Total costs for the 90-day feeding period are estimated to be $166 per head, which includes death loss and interest costs. The estimated net return for the heifer background program is $81 per head (see Figure 4). The graph that the tool provides is not illustrated in this example. However, for this example, the tool calculated the expected net return to fall between -$43 and $206 per head 90% of the time.

Hopefully, this decision-support tool will allow you as a producer to examine several retained ownership alternatives and make more informed decisions about how you want to market your cattle. The validity of the tools is only as valid as the data you enter, and there is no guarantee of the expected return.

Figure 3. Sample Screenshot of the Retained Ownership Decision Tool (Different Sections): Summer Grass

Figure 4. Example Sreenshot of the Retained Ownership Decision Tool (Different Sections): 90-day Heifer Background

References

- Feuz, D. (n.d.). Retained ownership decision tool calf stocker/background program. Utah State University Extension. https://farmanalysis.usu.edu/static/stocker/Stocker%20Decision%20Aide/Stocker%20decision%20aide%20 ut.htm

- Just, R. E., & Rausser, G. C. (1981). Commodity price forecasting with large-scale econometric models and the Futures market. American Journal of Agricultural Economics, 63, 197–208.

- Kastens, T. L., Jones, R., & Schroeder, T. C. (1998.) Futures-based price forecasts for agricultural producers and businesses. Journal of Agricultural and Resource Economics 23(1), 294–307.

- Poghosyan, A., Isengildina-Massa, O., & Stewart, S. L. (2021, August 1–3). Futures-based forecast of U.S. corn prices [Paper presentation]. Agricultural & Applied Economics Association Annual Meeting, Austin, Texas.

June 2024

Utah State University Extension

Peer-reviewed fact sheet

Authors

Dillon M. Feuz, Professor and Extension Specialist, Agricultural Economics, Utah State University;

Related Research