USU Extension

Juab County Office

Phone

435-623-3450

Hours

Monday - Thursday (Closed Fridays) 7:00 a.m.- 6:00 p.m.

What is USU Extension?

With offices covering Utah's 29 counties, Utah State University Extension provides research-based community education, resources and programs in the areas of agriculture and natural resources; business and community; food, health, and wellness; home, finance, and relationships; and 4-H and youth.How We Can Help

USU Extension offers expertise and pertinent information specific to the needs of our county

4-H and Youth

4-H is learning by doing, and is available to all boys and girls in the 3rd through 12th grades, from urban, suburban and rural areas. First, an adult leader brings together youth that have common interests. Second, the youth choose one or more projects. Projects are chosen from among 100 project areas offered, or if you don't see the one you like, you can create your own project. Third, the group enrolls as a club, and fourth meets together to learn and have fun. Clubs are able to explore 4-H activities, events and trips. In 4-H there are events happening all year round.

Juab County 4-H Programs & Activites

Helpful Links

Afterschool Program

4-H After School is a grant funded program designed to help youth enjoy enriching club activities in out of school time. Club leaders instruct groups of youth through various curriculum over the school year. Programs are available at Red Cliffs Elementary School, Mona Elementary School, Nebo View Elementary School, Juab Innovation Center, and Eureka Elementary School.

Juab County Fair Information - 2024 Information will be available soon!

Fair Links:

County Fair Registration 2023

Mandatory Online Registration

4-H Indoor Exhibits

Register at the http://juab4hexhibits.fairentry.com for non-livestock entries. Detailed instructions will be on our website (extension.usu.edu/juab). Individual trainings will be given upon request. You may call the office at 623-3450 for help and questions. If participants do not have access to the internet, please contact the Extension office.

4-H Livestock Exhibits

Register at the fairentry.com

Returning members must enroll every year to be active in 4-H. The 4-H year goes from September 1st to August 31st.

All members, new and returning, must be enroll by July 1st to be able to place entries in the 4-H section of the fair. If enrollment is not received by July 1st, the member will have to enter items in the open class sections.

Agriculture and Natural Resources

Upcoming Events

Ag Resources

Create Better Health

Create Better Health is Utah's SNAP-Ed Program. We provide nutrition education to low-income individuals and families throughout the state. Create Better Health holds workshops throughout Utah to promote healthy eating and active lifestyles among those receiving and eligible for food stamps.

In Juab County, Laurie Bates is our Create Better Health Ambassador, with over 20 years of experience, you can trust her with all your nutrition needs!

Juab County Create Better Health Facebook Page follow us on Facebook and make sure to watch for new classes!

Current Publications & Other Links

- USU Create Better Health

- Preserve the Harvest

- Food Safety

- Myplate.gov

- National School Breakfast and Lunch Program for Utah

- Preparedness

- Basic Information for Food Stamp Applicants

- Juab County WIC Programs

- Safetty in All Seasons

- Create Better Health Recipes

- Recipe Ingredient Conversion Calculator

- Household Tips and Ideas

Horticulture & Gardening

Horticulture faculty member Taun Beddes!

Taun was raised around agriculture, and his first job was on a local farm. Since then, he has continued to work in and with the local green industry and still enjoys working directly in the soil. Educationally, Taun has a B.S. of Ornamental Horticulture and an M.S. in Plant Science. He currently is employed by Utah State University Extension as a horticulturist. He primarily works in Utah County with commercial fruit and vegetable growers. He also helps homeowners and hobbyists with their gardening questions.

Upcoming Events

Community Garden

People of all ages enjoy the benefits of gardening. Because of housing situations for some residents, they are not able to participate in gardening activities. The new Juab County Community Garden will provide the opportunity for all residents to enjoy the benefits of gardening. There are 20 individuals plots sized at 4' x 10' located on the north side of the Juab County Fairgrounds in Nephi. The plots will be filled on a first served basis. 2024 Garden Links/Information:

Community Garden Guidelines and Policies

Community Garden 2024 Application

Drip Irrigation

Soil Testing Resources

Additional Resources

- Center for Water Efficient Landscaping (CWEL)

- Production Horticulture

- Protectors of Urban Pollinators (PUPs)

- Weed Guides

- Online Course Catalog

Garden Centers:

Home and Community

Upcoming Events

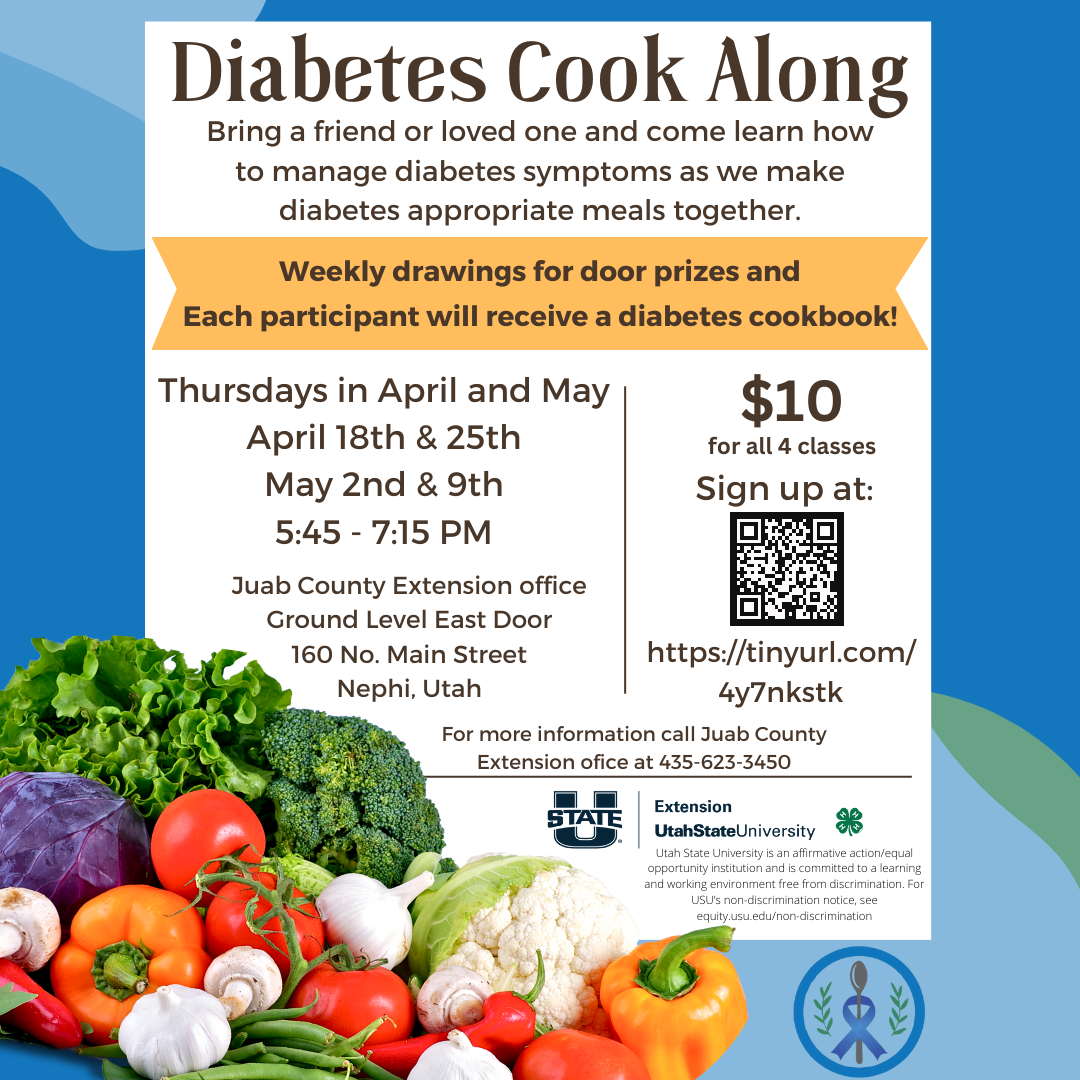

Diabetes Cook Along

Join our Diabetes Cook Along Classes! Starting Thursday April 18th! Bring a friend or loved one and come learn how to manage diabetes symptoms as we mke diabetes appropriate meals together! Each participant will receive a diabetes cookbook along with a chance to win prizes!

We have limited spots available! Register today at https://tinyurl.com/4y7nkstk

Household Information Records Organizer

We're launching a pilot program and we can't do it without you! Introducing the HIRO- your Household Information Records Organizer! Keep all your important documents and information updated and in one convenient spot!

HOW DOES IT WORK?

1. It's a Free Program! Thank you for helping us!

2. Stop by our office to pick up your HIRO binder or call us to reseve yours!

3. Take the binder home and fill our each section with your vital information!

4. Complete the survey includeded in your binder to help us improve the program!

5. Keep the binder safe at home and simply bring back the survey to our office!

Finish by the end of March and receive a prize! Thanks for working with us to organize and empower our housholds together!

Food Preservation Equipment for Rent:

We have multiple items of food preservation for rent, including our newest addition - the Freeze Dryer!

Check out the prices below:

Freeze Dryer Rental - $10 per week (4 days) Must take class prior to rental

Mylar Bags for Freeze Dried Items - $0.50 each

21.45 Quart Canner Pot with Jar Rack - $2 per day

Automatic Jam/Jelly Maker - $2 per day

16 Quart Pressure Canner - $5 per day

23 Quart Pressure Canner $5 per day

Apple Corer - $2 per day

Ball 21 Quart Multi Cooker - $5 per day

Utensil Set for Preserving & Strainer – included with rent out or $2 per day

Batter Dispenser - Free Check Out

For Sale Pint Jars - $15 for pack of 12

Other Services Available for Cost:

Copies Black and White - $0.10 each

Copies Colored - $0.25 each

USU Extension Juab County Contact Information

To contact us by email, you can reach us at juabextension@usu.edu.

Utah 4-H & Youth

Utah 4-H & Youth